Can You Imagine How Jubilant GetBusy's (LON:GETB) Shareholders Feel About Its 174% Share Price Gain?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you buy shares in a really great company, you can more than double your money. For instance the GetBusy plc (LON:GETB) share price is 174% higher than it was three years ago. That sort of return is as solid as granite. Also pleasing for shareholders was the 19% gain in the last three months.

View our latest analysis for GetBusy

While GetBusy made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 3 years GetBusy saw its revenue grow at 14% per year. That's pretty nice growth. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 40% per year over three years. The business has made good progress on the top line, but the market is extrapolating the growth. It would be worth thinking about when profits will flow, since that milestone will attract more attention.

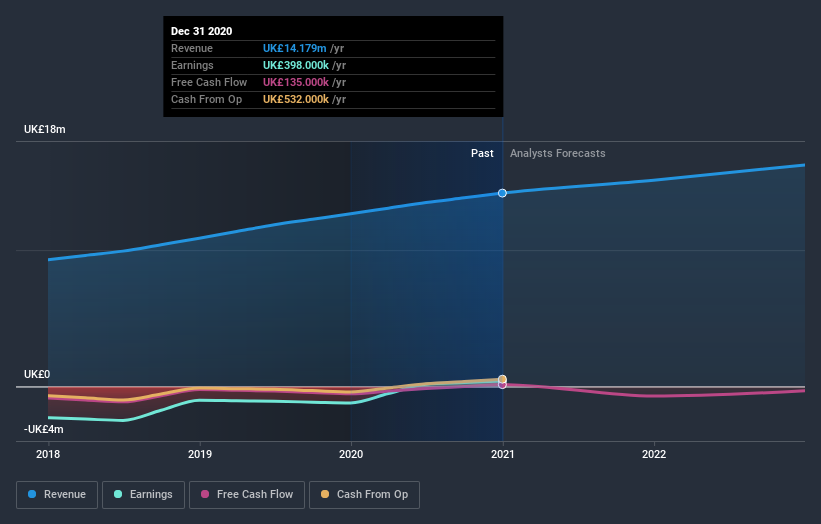

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that GetBusy has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling GetBusy stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that GetBusy rewarded shareholders with a total shareholder return of 75% over the last year. That's better than the annualized TSR of 40% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with GetBusy (including 1 which is significant) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.