Imagine Owning Bank of Chongqing (HKG:1963) And Wondering If The 33% Share Price Slide Is Justified

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Bank of Chongqing Co., Ltd. (HKG:1963) shareholders, since the share price is down 33% in the last three years, falling well short of the market return of around 12%. Unhappily, the share price slid 1.9% in the last week.

Check out our latest analysis for Bank of Chongqing

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

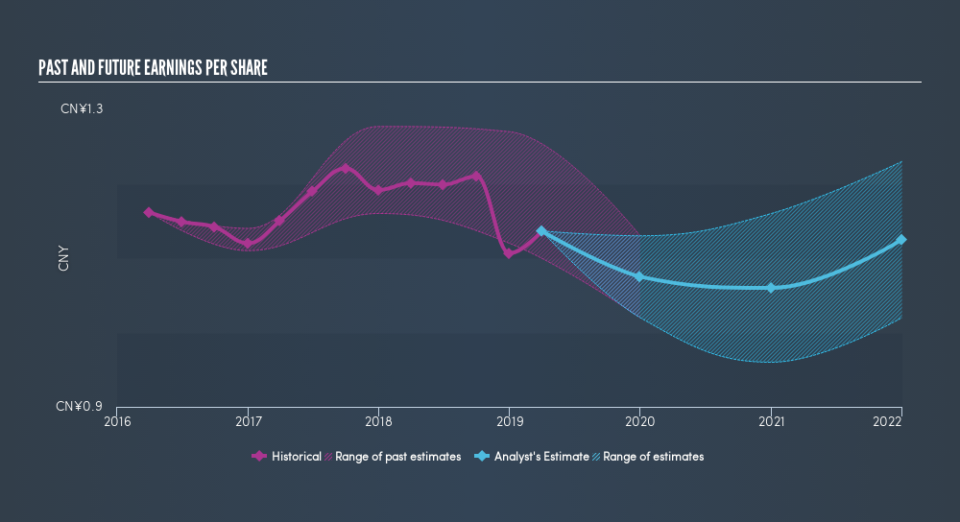

During the three years that the share price fell, Bank of Chongqing's earnings per share (EPS) dropped by 0.7% each year. This reduction in EPS is slower than the 12% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. This increased caution is also evident in the rather low P/E ratio, which is sitting at 3.33.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Bank of Chongqing's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Bank of Chongqing the TSR over the last 3 years was -24%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Bank of Chongqing shareholders are down 6.6% over twelve months (even including dividends), which isn't far from the market return of -6.9%. The silver lining is that longer term investors would have made a total return of 0.2% per year over half a decade. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. Before forming an opinion on Bank of Chongqing you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

We will like Bank of Chongqing better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.