Imagine Owning Bank of Princeton (NASDAQ:BPRN) And Wondering If The 26% Share Price Slide Is Justified

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term The Bank of Princeton (NASDAQ:BPRN) shareholders, since the share price is down 26% in the last three years, falling well short of the market return of around 16%. And over the last year the share price fell 24%, so we doubt many shareholders are delighted. Furthermore, it's down 25% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 20% in the same period.

View our latest analysis for Bank of Princeton

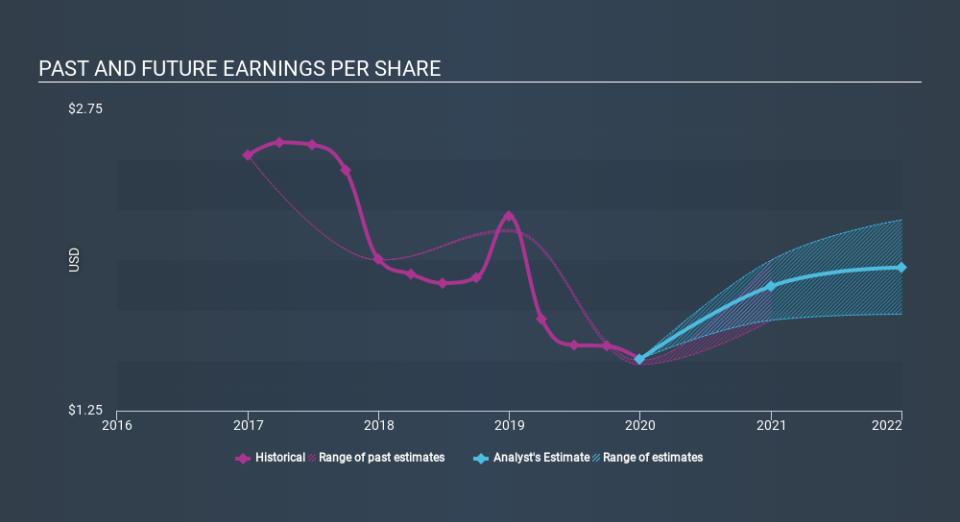

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years that the share price fell, Bank of Princeton's earnings per share (EPS) dropped by 16% each year. This fall in the EPS is worse than the 9.6% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of Bank of Princeton's earnings, revenue and cash flow.

A Different Perspective

Bank of Princeton shareholders are down 24% for the year (even including dividends) , falling short of the market return. The market shed around 7.2%, no doubt weighing on the stock price. Shareholders have lost 9.3% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Bank of Princeton by clicking this link.

Bank of Princeton is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.