Imagine Owning Bhandari Hosiery Exports (NSE:BHANDHOS) And Wondering If The 43% Share Price Slide Is Justified

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by Bhandari Hosiery Exports Limited (NSE:BHANDHOS) shareholders over the last year, as the share price declined 43%. That falls noticeably short of the market return of around -13%. Bhandari Hosiery Exports hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The falls have accelerated recently, with the share price down 29% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

See our latest analysis for Bhandari Hosiery Exports

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Bhandari Hosiery Exports share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth. The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

Given the yield is quite low, at 0.7%, we doubt the dividend can shed much light on the share price. Bhandari Hosiery Exports's revenue is actually up 3.2% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

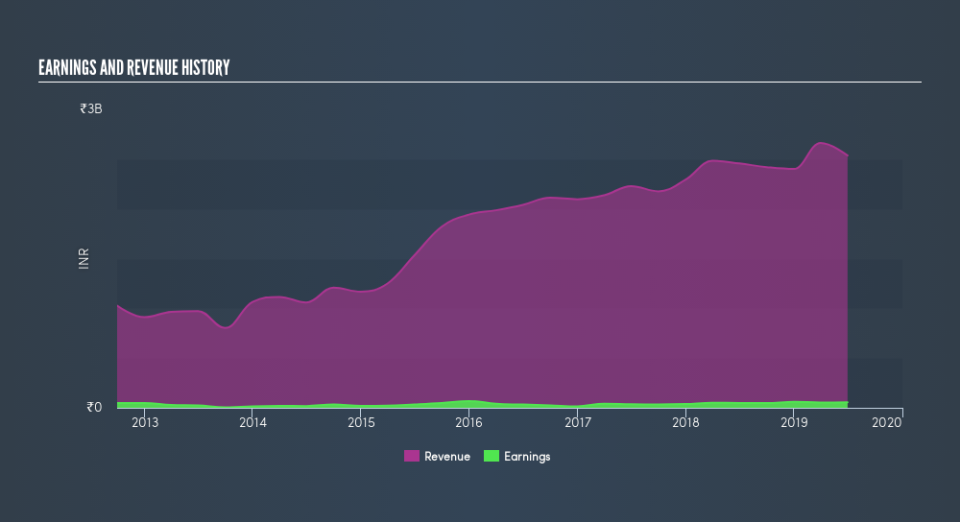

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Bhandari Hosiery Exports shareholders are down 42% for the year (even including dividends), even worse than the market loss of 13%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 29% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. You could get a better understanding of Bhandari Hosiery Exports's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.