Imagine Owning Canvest Environmental Protection Group (HKG:1381) And Wondering If The 16% Share Price Slide Is Justified

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Investors in Canvest Environmental Protection Group Company Limited (HKG:1381) have tasted that bitter downside in the last year, as the share price dropped 16%. That falls noticeably short of the market return of around 4.4%. However, the longer term returns haven't been so bad, with the stock down 1.7% in the last three years.

View our latest analysis for Canvest Environmental Protection Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Canvest Environmental Protection Group share price fell, it actually saw its earnings per share (EPS) improve by 28%. It's quite possible that growth expectations may have been unreasonable in the past.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

With a low yield of 1.3% we doubt that the dividend influences the share price much. Canvest Environmental Protection Group managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

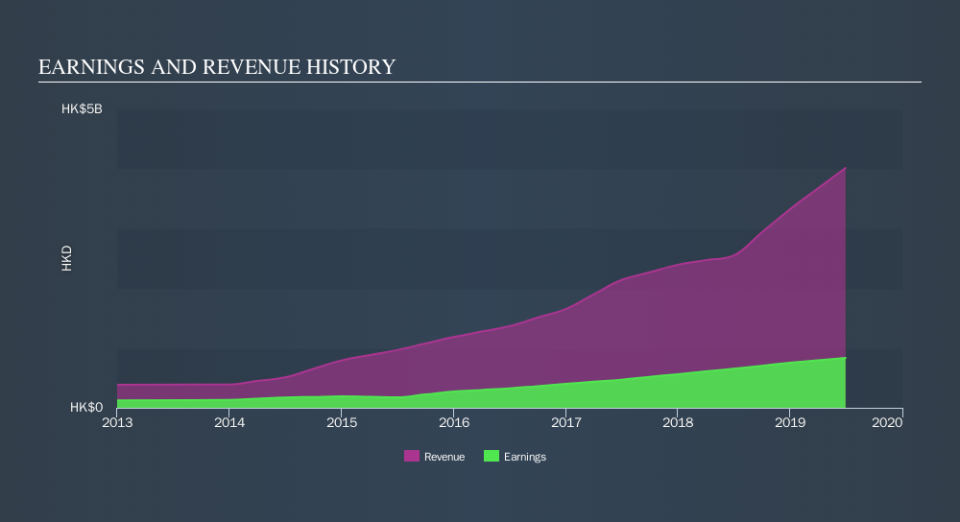

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Canvest Environmental Protection Group is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Canvest Environmental Protection Group stock, you should check out this free report showing analyst consensus estimates for future profits.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Canvest Environmental Protection Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Canvest Environmental Protection Group shareholders, and that cash payout explains why its total shareholder loss of 15%, over the last year, isn't as bad as the share price return.

A Different Perspective

The last twelve months weren't great for Canvest Environmental Protection Group shares, which cost holders 15% , including dividends , while the market was up about 4.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 0.5% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Before deciding if you like the current share price, check how Canvest Environmental Protection Group scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.