Imagine Owning China Chengtong Development Group (HKG:217) While The Price Tanked 59%

If you love investing in stocks you're bound to buy some losers. But the long term shareholders of China Chengtong Development Group Limited (HKG:217) have had an unfortunate run in the last three years. Sadly for them, the share price is down 59% in that time. And over the last year the share price fell 30%, so we doubt many shareholders are delighted. On top of that, the share price has dropped a further 13% in a month. We do note, however, that the broader market is down 10% in that period, and this may have weighed on the share price.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for China Chengtong Development Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Although the share price is down over three years, China Chengtong Development Group actually managed to grow EPS by 8.6% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past. It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

We note that, in three years, revenue has actually grown at a 28% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worht worth investigating China Chengtong Development Group further; while we may be missing something on this analysis, there might also be an opportunity.

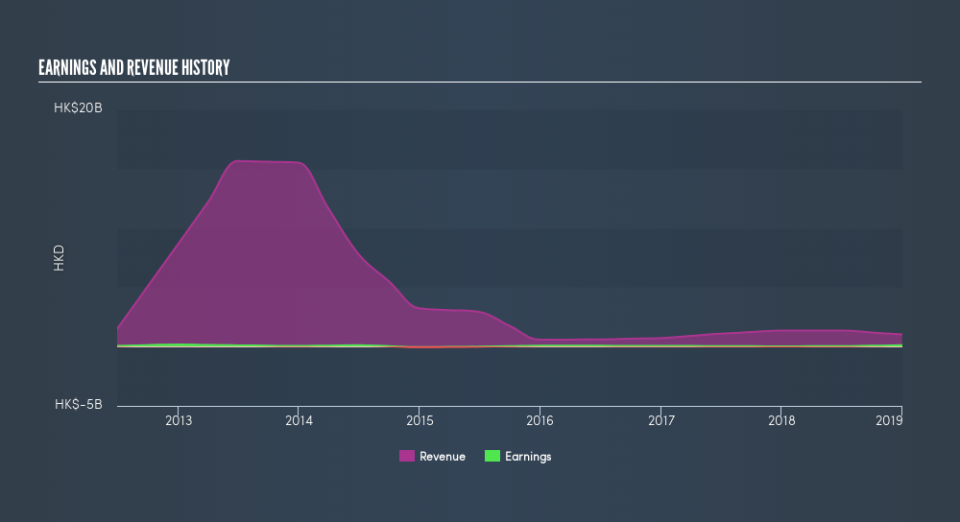

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on China Chengtong Development Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that China Chengtong Development Group shareholders are down 30% for the year. Unfortunately, that's worse than the broader market decline of 14%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 0.4%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before deciding if you like the current share price, check how China Chengtong Development Group scores on these 3 valuation metrics.

We will like China Chengtong Development Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.