Imagine Owning China Energy Engineering (HKG:3996) And Wondering If The 45% Share Price Slide Is Justified

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term China Energy Engineering Corporation Limited (HKG:3996) shareholders, since the share price is down 45% in the last three years, falling well short of the market return of around -5.3%. Furthermore, it's down 16% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 17% decline in the broader market, throughout the period.

View our latest analysis for China Energy Engineering

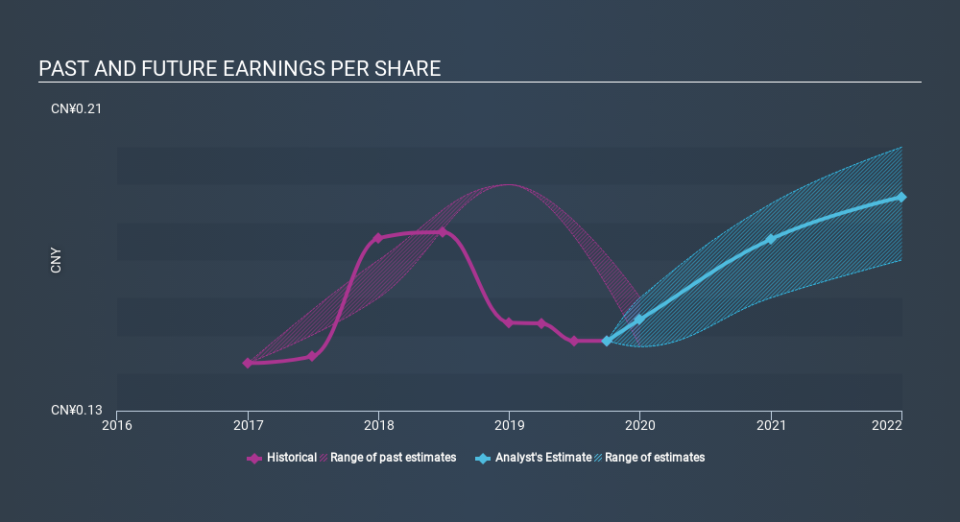

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of China Energy Engineering, it has a TSR of -40% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We can sympathize with China Energy Engineering about their 14% loss for the year ( including dividends) , but the silver lining is that the broader market return was worse, at around -20%. The one-year return is also not as bad as the 16% per annum loss investors have suffered over the last three years. It could well be that the business has begun to stabilize, though the recent returns are hardly impressive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with China Energy Engineering (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

Of course China Energy Engineering may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.