Imagine Owning China Leon Inspection Holding (HKG:1586) And Wondering If The 13% Share Price Slide Is Justified

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's easy to feel disappointed if you buy a stock that goes down. But often it is not a reflection of the fundamental business performance. So while the China Leon Inspection Holding Limited (HKG:1586) share price is down 13% in the last year, the total return to shareholders (which includes dividends) was -12%. And that total return actually beats the market return of -13%. China Leon Inspection Holding may have better days ahead, of course; we've only looked at a one year period.

Check out our latest analysis for China Leon Inspection Holding

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

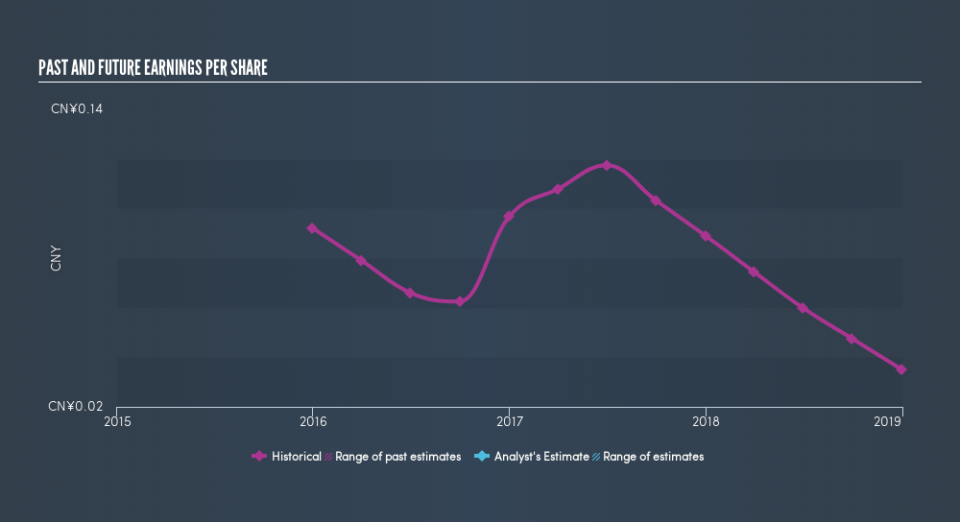

Unfortunately China Leon Inspection Holding reported an EPS drop of 61% for the last year. This fall in the EPS is significantly worse than the 13% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into China Leon Inspection Holding's key metrics by checking this interactive graph of China Leon Inspection Holding's earnings, revenue and cash flow.

A Different Perspective

Having lost 12% over the year, including dividends, China Leon Inspection Holding has generated a return within the same ballpark as the broader market. Unfortunately, last year's performance may indicate unresolved challenges, and the share price has continued to drop, down 5.0% over the last three months. It's not uncommon to see companies without long term track records disappoint shareholders. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.