Imagine Owning China Shanshui Cement Group (HKG:691) And Wondering If The 23% Share Price Slide Is Justified

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in China Shanshui Cement Group Limited (HKG:691), since the last five years saw the share price fall 23%. Shareholders have had an even rougher run lately, with the share price down 12% in the last 90 days.

Check out our latest analysis for China Shanshui Cement Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, China Shanshui Cement Group moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

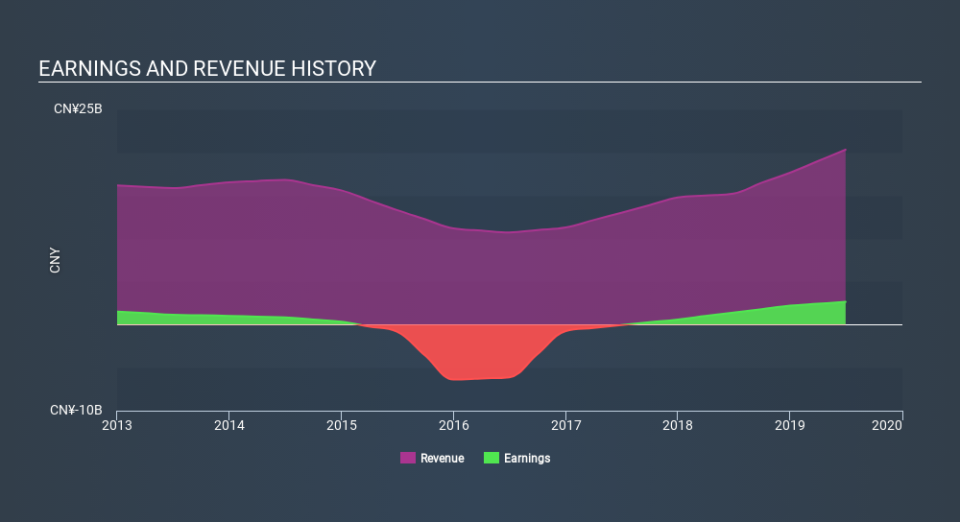

In contrast to the share price, revenue has actually increased by 5.2% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at China Shanshui Cement Group's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that China Shanshui Cement Group shareholders have received a total shareholder return of 3.7% over the last year. There's no doubt those recent returns are much better than the TSR loss of 5.1% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. You could get a better understanding of China Shanshui Cement Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like China Shanshui Cement Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.