Imagine Owning China State Construction International Holdings (HKG:3311) And Wondering If The 44% Share Price Slide Is Justified

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in China State Construction International Holdings Limited (HKG:3311), since the last five years saw the share price fall 44%. We also note that the stock has performed poorly over the last year, with the share price down 26%. Unfortunately the share price momentum is still quite negative, with prices down 9.7% in thirty days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for China State Construction International Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

While the share price declined over five years, China State Construction International Holdings actually managed to increase EPS by an average of 4.7% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past. Based on these numbers, we'd venture that the market may have been over-optimistic about forecast growth, half a decade ago. Having said that, we might get a better idea of what's going on with the stock by looking at other metrics.

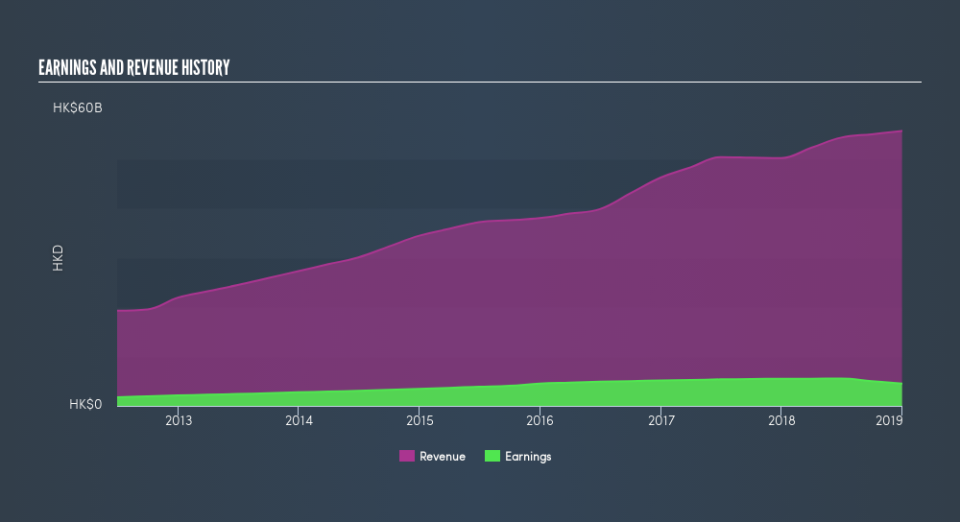

Revenue is actually up 14% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

China State Construction International Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for China State Construction International Holdings in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, China State Construction International Holdings's TSR for the last 5 years was -35%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We regret to report that China State Construction International Holdings shareholders are down 23% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 1.6%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8.4% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Keeping this in mind, a solid next step might be to take a look at China State Construction International Holdings's dividend track record. This free interactive graph is a great place to start.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.