Imagine Owning Columbus Energy Resources (LON:CERP) And Taking A 95% Loss Square On The Chin

Columbus Energy Resources plc (LON:CERP) shareholders will doubtless be very grateful to see the share price up 62% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Five years have seen the share price descend precipitously, down a full 95%. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The important question is if the business itself justifies a higher share price in the long term.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Columbus Energy Resources

Because Columbus Energy Resources is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

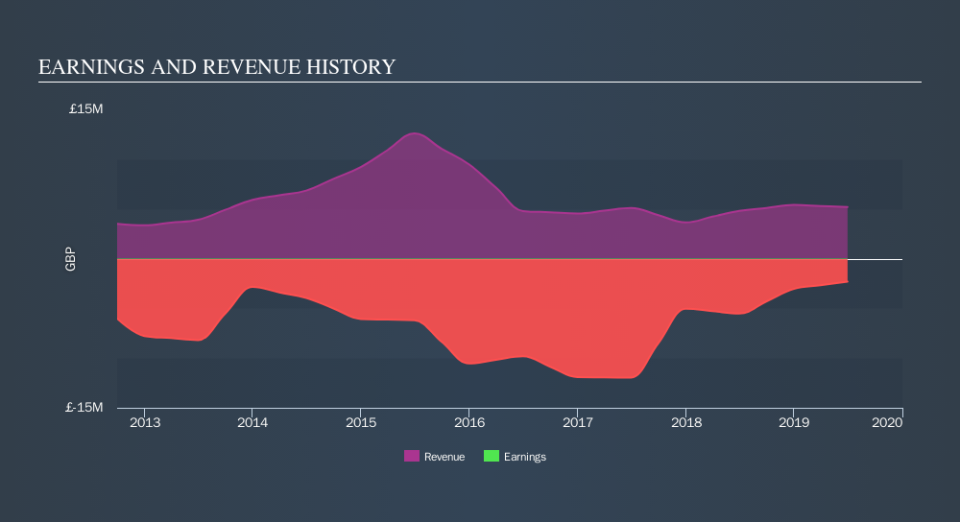

In the last five years Columbus Energy Resources saw its revenue shrink by 18% per year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 46% per year in the same time period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Columbus Energy Resources stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Columbus Energy Resources had a tough year, with a total loss of 6.0%, against a market gain of about 3.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 46% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.