Imagine Owning CSSC Offshore & Marine Engineering (Group) (HKG:317) While The Price Tanked 56%

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example the CSSC Offshore & Marine Engineering (Group) Company Limited (HKG:317) share price dropped 56% over five years. We certainly feel for shareholders who bought near the top. And it's not just long term holders hurting, because the stock is down 37% in the last year. On top of that, the share price has dropped a further 23% in a month.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for CSSC Offshore & Marine Engineering (Group)

CSSC Offshore & Marine Engineering (Group) isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

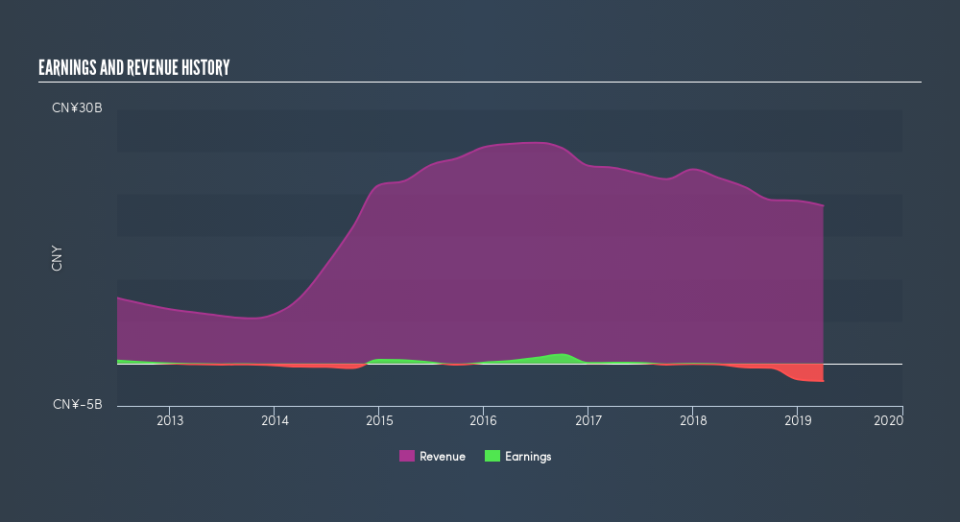

Over five years, CSSC Offshore & Marine Engineering (Group) grew its revenue at 4.3% per year. That's far from impressive given all the money it is losing. This lacklustre growth has no doubt fueled the loss of 15% per year, in that time. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on CSSC Offshore & Marine Engineering (Group)

A Different Perspective

We regret to report that CSSC Offshore & Marine Engineering (Group) shareholders are down 37% for the year. Unfortunately, that's worse than the broader market decline of 14%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 15% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course CSSC Offshore & Marine Engineering (Group) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.