Imagine Owning Huakang Biomedical Holdings (HKG:8622) While The Price Tanked 60%

The nature of investing is that you win some, and you lose some. And unfortunately for Huakang Biomedical Holdings Company Limited (HKG:8622) shareholders, the stock is a lot lower today than it was a year ago. In that relatively short period, the share price has plunged 60%. Because Huakang Biomedical Holdings hasn't been listed for many years, the market is still learning about how the business performs. The silver lining is that the stock is up 2.1% in about a week.

See our latest analysis for Huakang Biomedical Holdings

Given that Huakang Biomedical Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Huakang Biomedical Holdings's revenue didn't grow at all in the last year. In fact, it fell 7.5%. That's not what investors generally want to see. The share price drop of 60% is understandable given the company doesn't have profits to boast of. Having said that, if growth is coming in the future, the stock may have better days ahead. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

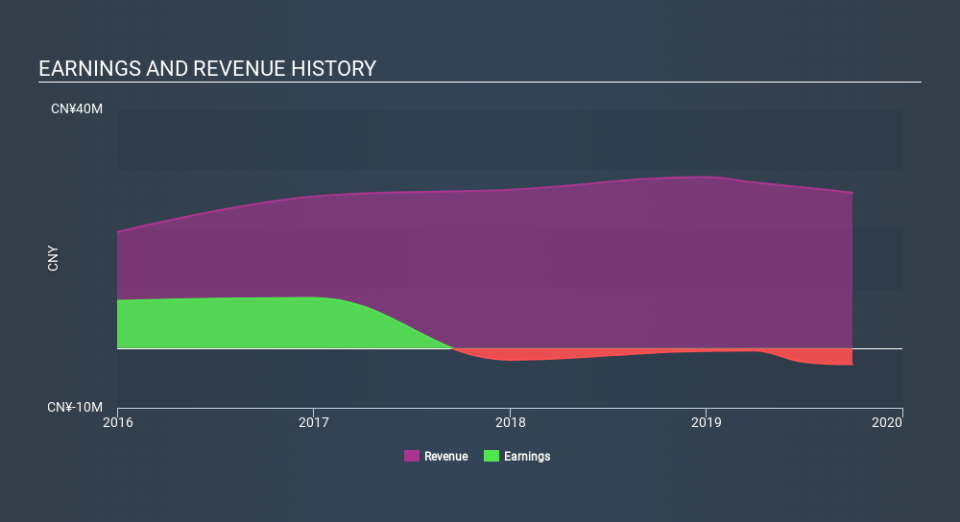

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Huakang Biomedical Holdings's earnings, revenue and cash flow.

A Different Perspective

While Huakang Biomedical Holdings shareholders are down 60% for the year, the market itself is up 6.1%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 10.0% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Huakang Biomedical Holdings (including 2 which is are a bit unpleasant) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.