Imagine Owning Impelus (ASX:IMS) And Taking A 97% Loss Square On The Chin

As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Impelus Limited (ASX:IMS); the share price is down a whopping 97% in the last three years. That would be a disturbing experience. The more recent news is of little comfort, with the share price down 57% in a year. Furthermore, it's down 23% in about a quarter. That's not much fun for holders.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for Impelus

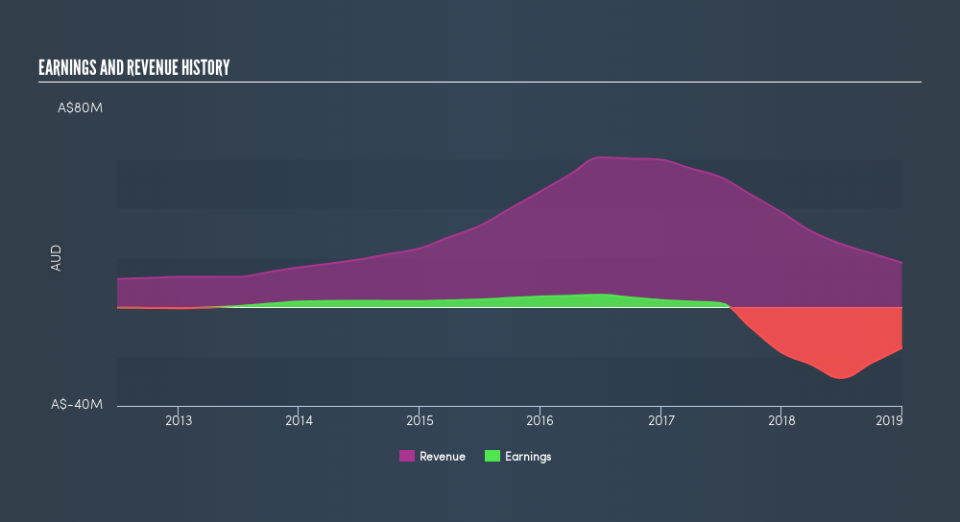

Impelus isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Impelus's revenue dropped 31% per year. That means its revenue trend is very weak compared to other loss making companies. And as you might expect the share price has been weak too, dropping at a rate of 69% per year. We prefer leave it to clowns to try to catch falling knives, like this stock. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Take a more thorough look at Impelus's financial health with this free report on its balance sheet.

A Different Perspective

Impelus shareholders are down 57% for the year, but the market itself is up 8.5%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 44% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before spending more time on Impelus it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.