Imagine Owning redT energy (LON:RED) And Trying To Stomach The 80% Share Price Drop

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of redT energy plc (LON:RED), who have seen the share price tank a massive 80% over a three year period. That would be a disturbing experience. And over the last year the share price fell 72%, so we doubt many shareholders are delighted. Furthermore, it's down 68% in about a quarter. That's not much fun for holders.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for redT energy

redT energy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

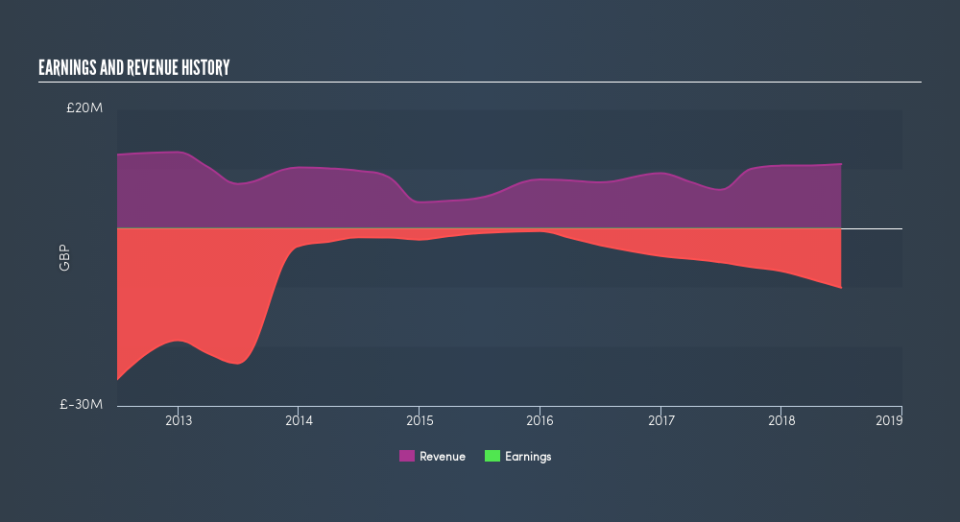

Over three years, redT energy grew revenue at 17% per year. That's a pretty good rate of top-line growth. So it's hard to believe the share price decline of 42% per year is due to the revenue. It could be that the losses were much larger than expected. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

This free interactive report on redT energy's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

redT energy shareholders are down 72% for the year, but the market itself is up 7.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 19% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course redT energy may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.