Imagine Owning Shenguan Holdings (Group) (HKG:829) And Trying To Stomach The 85% Share Price Drop

While it may not be enough for some shareholders, we think it is good to see the Shenguan Holdings (Group) Limited (HKG:829) share price up 12% in a single quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Five years have seen the share price descend precipitously, down a full 85%. The recent bounce might mean the long decline is over, but we are not confident. The million dollar question is whether the company can justify a long term recovery.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Shenguan Holdings (Group)

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

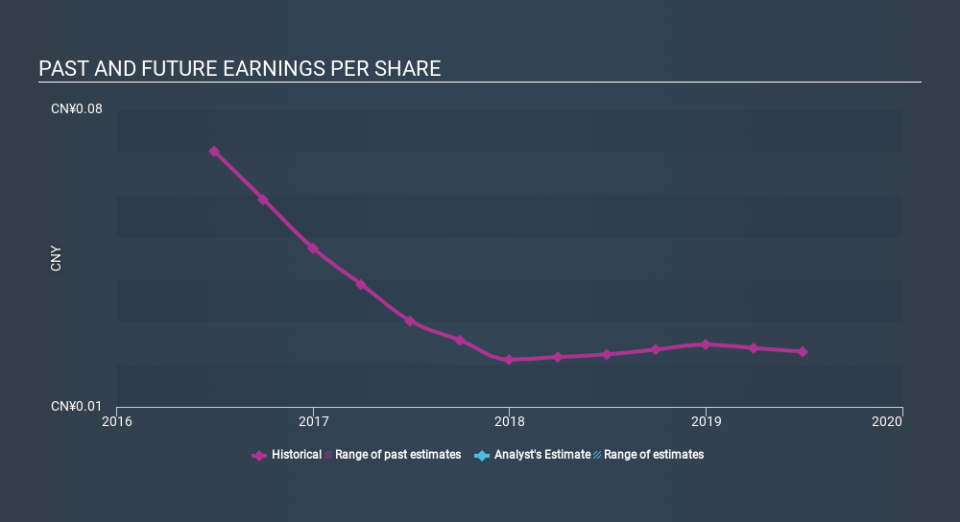

Looking back five years, both Shenguan Holdings (Group)'s share price and EPS declined; the latter at a rate of 37% per year. Notably, the share price has fallen at 32% per year, fairly close to the change in the EPS. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on Shenguan Holdings (Group)'s earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Shenguan Holdings (Group), it has a TSR of -80% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Shenguan Holdings (Group) shareholders are down 18% for the year (even including dividends) , but the market itself is up 4.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 27% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Shenguan Holdings (Group) (1 is a bit concerning!) that you should be aware of before investing here.

Shenguan Holdings (Group) is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.