Imagine Owning Star Combo Pharma (ASX:S66) And Wondering If The 31% Share Price Slide Is Justified

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Star Combo Pharma Limited (ASX:S66) shareholders over the last year, as the share price declined 31%. That's well bellow the market return of 17%. Star Combo Pharma hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. It's down 37% in about a quarter.

See our latest analysis for Star Combo Pharma

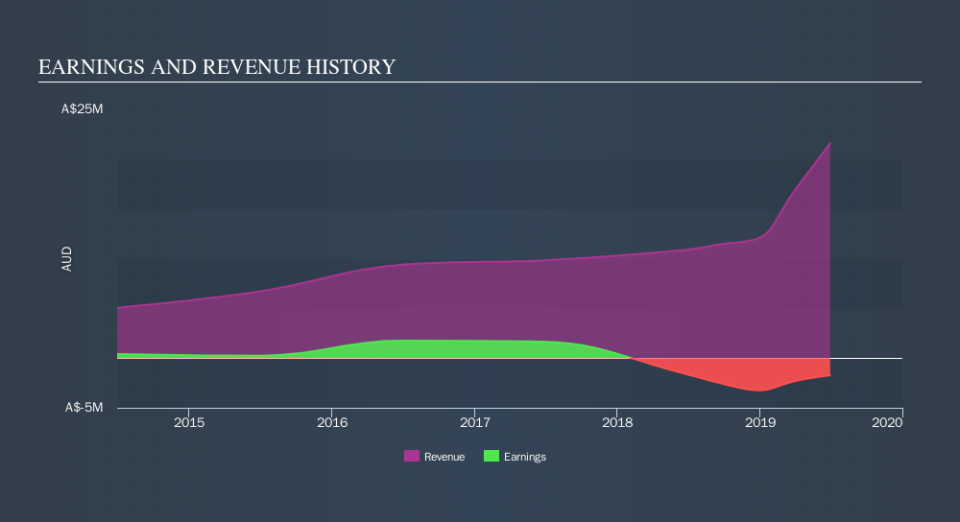

Because Star Combo Pharma is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Star Combo Pharma grew its revenue by 98% over the last year. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 31% seems quite harsh. Our sympathies to shareholders who are now underwater. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Star Combo Pharma's earnings, revenue and cash flow.

A Different Perspective

Given that the market gained 17% in the last year, Star Combo Pharma shareholders might be miffed that they lost 31%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's worth noting that the last three months did the real damage, with a 37% decline. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. You could get a better understanding of Star Combo Pharma's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Star Combo Pharma may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.