Imagine Owning Tse Sui Luen Jewellery (International) (HKG:417) While The Price Tanked 51%

For many, the main point of investing is to generate higher returns than the overall market. But even the best stock picker will only win with some selections. So we wouldn't blame long term Tse Sui Luen Jewellery (International) Limited (HKG:417) shareholders for doubting their decision to hold, with the stock down 51% over a half decade. We also note that the stock has performed poorly over the last year, with the share price down 41%. The falls have accelerated recently, with the share price down 21% in the last three months.

View our latest analysis for Tse Sui Luen Jewellery (International)

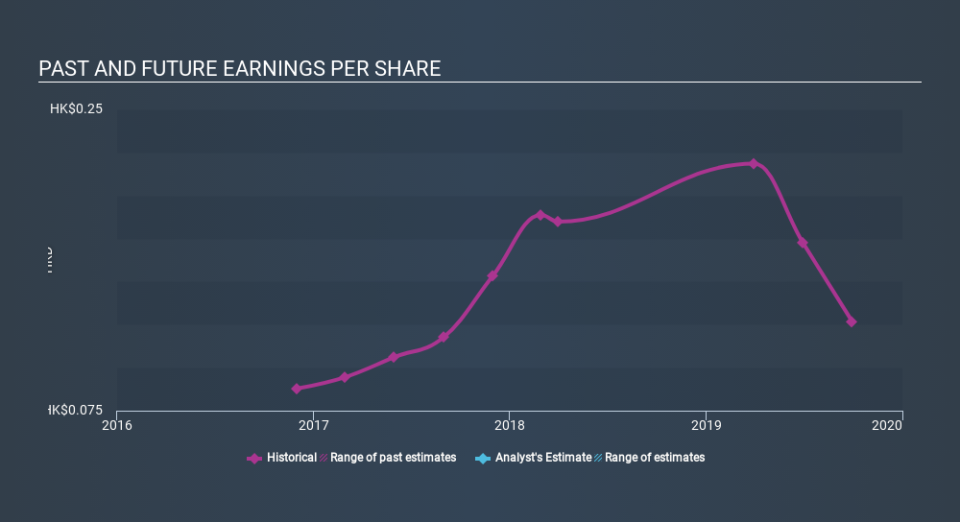

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Looking back five years, both Tse Sui Luen Jewellery (International)'s share price and EPS declined; the latter at a rate of 10% per year. This reduction in EPS is less than the 13% annual reduction in the share price. This implies that the market is more cautious about the business these days. The low P/E ratio of 8.68 further reflects this reticence.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Tse Sui Luen Jewellery (International)'s key metrics by checking this interactive graph of Tse Sui Luen Jewellery (International)'s earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Tse Sui Luen Jewellery (International)'s share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Tse Sui Luen Jewellery (International)'s TSR of was a loss of 43% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Tse Sui Luen Jewellery (International) shareholders are down 39% for the year, but the market itself is up 0.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for Tse Sui Luen Jewellery (International) you should be aware of, and 1 of them makes us a bit uncomfortable.

We will like Tse Sui Luen Jewellery (International) better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.