Impacts of Rising Mortgage Rates: A Conversation With Senior Economist Matthew Speakman

Matthew Speakman is a senior economist at Zillow. He shared his thoughts about what is driving the recent spike in mortgage rates, how that will impact the broader housing market, and where the market will go from here.

What is causing this rapid rise in rates?

A number of factors have pushed mortgage rates firmly higher this year, but inflationary pressures are the main culprit.

All else being equal, inflation places upward pressure on bond yields, which generally dictate the path of mortgage rates. Inflation is running at a 40-year high and mortgage rates have, by some measures, seen the highest annual growth since the late 1970s. Needless to say, investors are eagerly searching for signs that inflation is cooling. Hints of calming price growth in May led mortgage rates to temporarily plateau. But May's official inflation data came in hotter than expected, prompting a tremendously strong surge higher for mortgage rates in the days that followed.

Mortgage rates also reflect markets' expectations for how the Federal Reserve is going to tighten monetary policy in order to rein in rising prices. Somewhat confusingly, the Fed's actions are actually less influential on mortgage rates than the market's expectations for what the central bank is going to do going forward. Fears that the hotter-than-expected May inflation data would lead the Fed to make a much more aggressive policy decision helped influence the rapid hike in mortgage rates in mid-June. The bank's actual decision to increase overnight rates by 75 bps actually resulted in a decline in mortgage rates.

While mortgage rates remain very high compared to recent years, they've come down a bit since the frenzy of mid-June. Inflationary pressures are showing few signs of abating, but the Fed's insistence that it is "strongly committed" to curbing inflation has caused some investors to soften their growth outlook for the years ahead. This change in tune has introduced some downward pressure on bond yields and, thus, mortgage rates in recent days.

What do you think will happen to rates in the future?

It's always extremely difficult to predict mortgage rate movements, particularly at a time with such economic and geopolitical uncertainty like there is today. As an example, there's been a general belief mortgage rates would rise this year, but few could have predicted what has played out over the last few weeks – both the surge higher in mid-June and the pullback of rates in recent days.

As I mentioned earlier, concerns about persistent inflation will continue to have a strong influence on mortgage rates until there is ample evidence that price growth is easing. The pandemic and geopolitical developments are also inputs into this calculus. Concerns about the economy's longer-term growth prospects, and the potential of a recession in the near-future, are also factoring into the market's outlook for bond yields, which generally influence mortgage rates.

What impact could this have on the housing market?

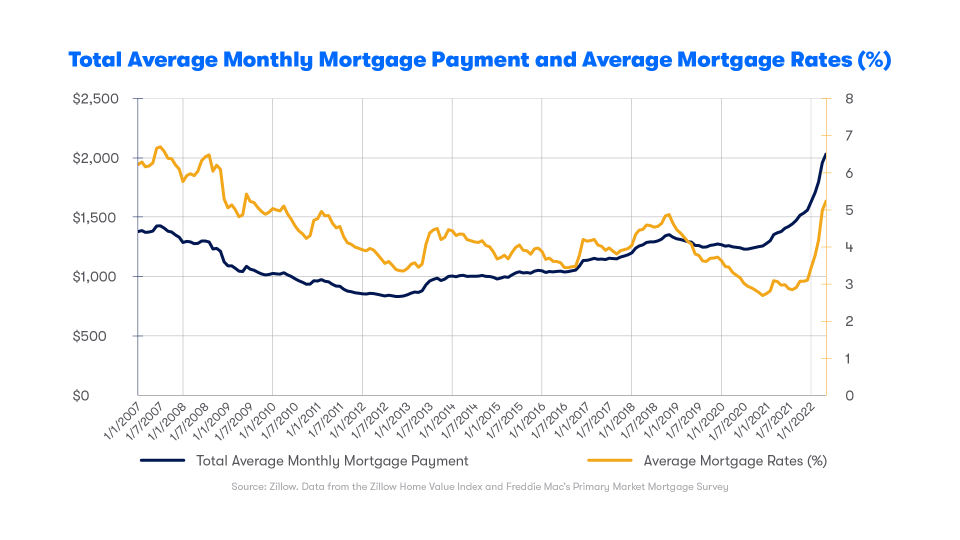

Higher mortgage costs should calm demand and usher in some much-needed rebalancing of the market. The combination of the recent record-breaking pace of home value growth and suddenly high mortgage rates has severely worsened housing affordability. Our affordability measure shows that a monthly mortgage payment on the nation's typical home makes up a greater share of median homeowner income than at any time since at least 2007, and possibly much longer. These worsening conditions are already having an impact on the market – home price growth has started to soften and price cuts are becoming more common, as sellers are finally being challenged and begin to reconsider their expectations.

Mortgage rates' rise pushes monthly payments skyward

While they remain low by historical standards, for-sale inventory levels have risen. A slower pace of sales has resulted in more homes staying on the market for longer. New listing activity continues to lag behind recent years.

It's important to remember that while mortgage rates are certainly not the only reason why homeowners decide to move, they do factor into the equation, and for some potential movers, the prospect of giving up their current mortgage and taking on one with a rate that is nearly double their current one is enough to back out of the transaction.

What would happen if rates went back down?

A sharp reduction in mortgage rates would naturally reenergize activity in the housing market, and incentivize some buyers and sellers who are currently on the fence to jump back into the market. Overall affordability challenges would persist as prices remain high, but it's likely that many potential buyers – particularly those first time buyers who have faced an extraordinarily competitive market over the past couple years – would view lower rates as an opportunity to finally enter the market. On the seller’s side, those who are concerned about having to take on a higher rate if they were to give up their current one would of course be faced with an easier-to-digest scenario.

The post Impacts of Rising Mortgage Rates: A Conversation With Senior Economist Matthew Speakman appeared first on Zillow Research.