Is Indian Metals and Ferro Alloys (NSE:IMFA) Using Too Much Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Indian Metals and Ferro Alloys Limited (NSE:IMFA) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Indian Metals and Ferro Alloys

What Is Indian Metals and Ferro Alloys's Debt?

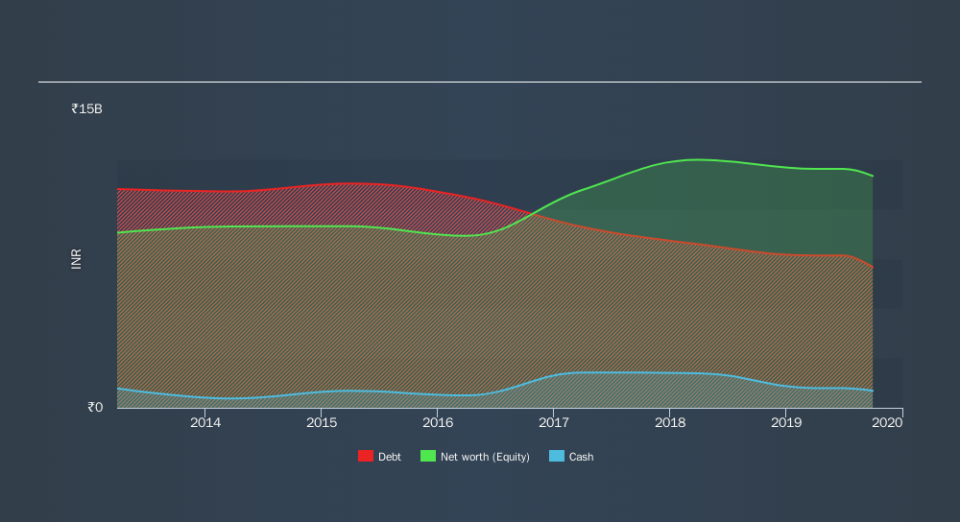

The image below, which you can click on for greater detail, shows that Indian Metals and Ferro Alloys had debt of ₹7.07b at the end of September 2019, a reduction from ₹7.66b over a year. However, it does have ₹852.2m in cash offsetting this, leading to net debt of about ₹6.22b.

A Look At Indian Metals and Ferro Alloys's Liabilities

According to the last reported balance sheet, Indian Metals and Ferro Alloys had liabilities of ₹7.35b due within 12 months, and liabilities of ₹6.28b due beyond 12 months. On the other hand, it had cash of ₹852.2m and ₹864.7m worth of receivables due within a year. So its liabilities total ₹11.9b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the ₹5.35b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we'd watch its balance sheet closely, without a doubt After all, Indian Metals and Ferro Alloys would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Indian Metals and Ferro Alloys's debt to EBITDA ratio (2.7) suggests that it uses some debt, its interest cover is very weak, at 1.9, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Worse, Indian Metals and Ferro Alloys's EBIT was down 50% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Indian Metals and Ferro Alloys will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, Indian Metals and Ferro Alloys recorded free cash flow worth 56% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

To be frank both Indian Metals and Ferro Alloys's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Taking into account all the aforementioned factors, it looks like Indian Metals and Ferro Alloys has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. While Indian Metals and Ferro Alloys didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away.Click here to see if its earnings are heading in the right direction, over the medium term.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.