Indiana House bill takes aim at discriminatory lending and home appraisals

An Indiana House Democrat has authored a bill aimed at stopping discrimination in residential real estate lending and appraisals.

House Bill 1326 by Rep. Cherrish Pryor, D-Indianapolis, prohibits discrimination in appraisals and lending based on the applicant's race, color, religion, sex, disability, familial status, national origin or on the residents of the neighborhood in which the property is located.

According to the language of the bill, this would include using the aforementioned characteristics as a basis for establishing terms and conditions on a residential real estate transaction, making an excessively low appraisal on property that is the subject of a mortgage loan and denying a qualified, creditworthy applicant a mortgage loan.

Indianapolis: Black homeowner had a white friend stand in for third appraisal. Her home value doubled.

The proposed bill has been assigned to the House committee on Financial Institutions and Insurance, where it seems unlikely to be heard before Tuesday's deadline to pass bills out of committees.

Pryor said she proposed the bill because she wanted people to have fair appraisals of their property regardless of their race or the community in which they live. An IndyStar report in May detailed a fair housing lawsuit in which a Black Indianapolis woman's home appraisal rocketed after she removed all signs of her racial and cultural identity from the home and had the white husband of a friend stand in for her during the appraiser's visit.

Homeownership, Pryor said, can lift families out of poverty if they can pass down the property to future generations or pull equity from the home to pay for college tuition, make home repairs, or generate wealth.

"African Americans, their net wealth is just woefully below their white counterparts —a big piece of that is homeownership," she said. "The issue of discriminating against people ensures, and really enshrines, the fact that that wealth gap will stay in place, so we have to get at the practices that make that wealth gap."

Addressing system racism

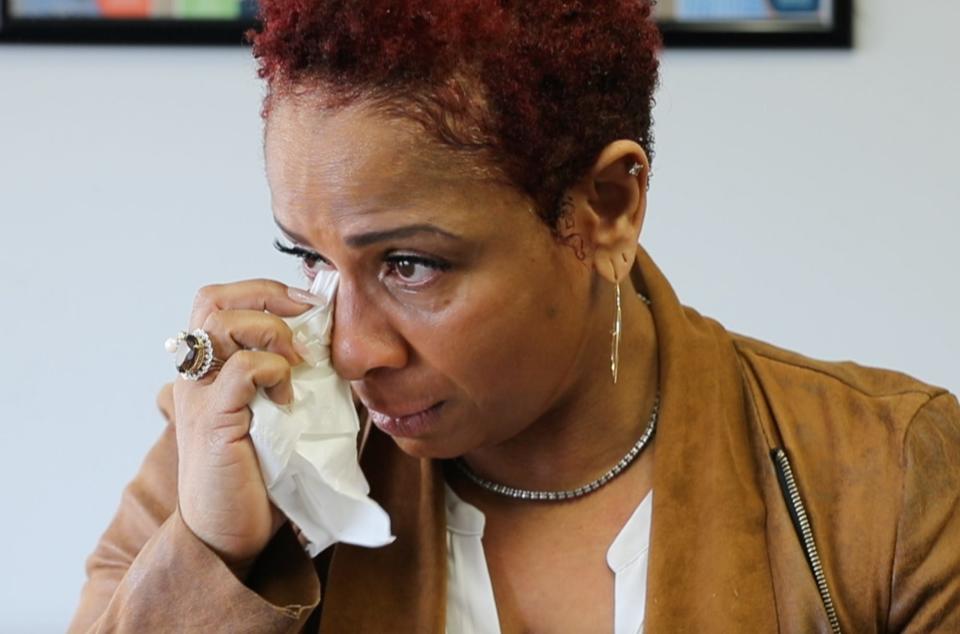

Pryor said she was motivated to author the legislation and introduce the bill after hearing the stories of Carlette Duffy, the Indianapolis woman came forward in May 2021 alleging racial discrimination in home appraisals she sought, and another individual who expressed concern about receiving a low appraisal while attempting to sell a condo.

Pryor did not identify that person, adding that she does not know the outcome of that situation. Old National Bank's agreement to settle a redlining complaint that alleged discrimination against Black borrowers in Indianapolis also influenced her decision.

Dig deeper: Old National Bank settles redlining allegations by expanding loans to Black neighborhoods

"People say you pull yourself up by your bootstraps, but when you give people boots that don't have soles, when you give people boots that don't have straps to them, it's pretty hard to pull themselves out of poverty," she said.

Duffy's story captured national interest after she and the Fair Housing Center of Central Indiana filed complaints against mortgage lenders and home appraisers she accused of undervaluing her home in the city's historic Flanner House Homes neighborhood near downtown.

Duffy said she received two low appraisals before having a white friend stand-in for her during a third appraisal. She also removed family photos, books and home décor that revealed or hinted at her race. The value of her home, she said, more than doubled between the second and third appraisals.

Amy Nelson, executive director of the Fair Housing Center of Central Indiana, said the U.S. Department of Housing and Urban Development is still investigating the complaints. Others have come forward in light of Duffy's allegations, she said, but they did not whitewash their homes as Duffy did, she added.

On Jan. 19, the National Fair Housing Alliance released a federally-funded 84-page report the alliance and its partners produced on behalf of the Appraisal Subcommittee of the Federal Financial Institutions Examination Council. The committee is an independent federal agency that provides oversight for the real estate appraisal industry.

In the report, the alliance also recommends governance of the appraisal industry and addressing gaps in fair housing requirements and training.

It also documents systemic racism in the nation's housing and financial markets, noting that racial discrimination in home appraisals continues to affect Black and Latino homeowners throughout the country.

"(The) New Deal’s federal Home Owners Loan Corporation developed one of the most harmful policy decisions in the housing and financial services markets by creating a system that included race as a fundamental factor in determining the desirability and value of neighborhoods," the report said.

HOLC's appraisal system, the report says, included color-coded maps that evaluated and graded the desirability of neighborhoods and perpetuated unfounded assumptions between race and risk in the national financial and housing markets.

Meanwhile, researchers at Freddie Mac, a government-sponsored agency that provides money for the U.S. housing market, analyzed millions of appraisals to determine if racial disparities exist. The researchers found that appraisal gaps were more likely to be found in majority-Black and Latino census tracts than white census tracts.

One reason is the sales comparison approach appraisers predominately use for single-family residential home valuation. The report notes that the approach — one of several used to determine home valuation — relies on comparable sales, contract sales, and listings of properties that are most comparable to the subject property.

Real estate: 'Appraisal creep' another factor in housing prices that could affect every homeowner

While race-neutral at face value, the approach opens the door for implicit or explicit discrimination, considering historical appraisal practices and the broad discretion appraisers had to determine each aspect of the appraisal, including the selection of comparable homes to analyze.

"The historical undervaluation of communities of color as well as the broad discretion leaves open the opportunity for appraisers to perpetuate bias on a passive or active basis," the report says. "That is, appraisers may passively or unwittingly perpetuate bias by continuing to use the undervalued comparable sales in neighborhoods of color."

Other provisions of the bill

In addition to prohibiting discrimination, Pryor's bill requires the real estate appraiser licensure and certification board to submit recommendations for rules that would require at least one hour each of cultural competency and implicit bias training as a condition of initial certification.

In a press release issued Thursday, Pryor said her bill aligns with the NFHA’s policy roadmap to address bias in the appraisal process.

The proposed bill establishes the fair housing practice fund, a pot of money that would provide restitution to individuals determined to be injured by discriminatory lending and home appraisals practices.

The fund, administered by the Indiana Housing and Community Development Authority, also would assist with residential real estate down payments and closing costs and grants for community education and outreach efforts.

State appropriations, fines resulting from final settlement or judgment, gifts and grants, and civil penalties collected from violations of the bill's provisions prohibiting discriminatory lending and appraisals would finance the fund.

Deadline nears for bill to be heard

The clock on whether Pryor's bill will be heard before the Indiana House's Tuesday deadline for bills to pass out of committee.

Rep. Martin Carbaugh, R-Fort Wayne, chairs the House's committee on Financial Institutions and Insurance. He could not be reached for comment Monday. The committee will meet at 8:30 a.m. Tuesday, but it will only hear two bills, one on charities paying bail for indigent offenders and another on government contracts.

The Fair Housing Center of Center Indiana supports the bill. Pryor said she relied on information from the center to draft some of the bill's provisions.

Nelson, of the Fair Housing Center, said Indiana needs to take more aggressive steps to counteract its housing crisis. That includes the presence of bias and discrimination in housing transactions.

Indiana: What to do if you suspect discrimination in home appraisals

"Our work has also raised awareness that appraisal discrimination is happening in our community, and we need to do more to stop it from occurring," she said. "This legislation would provide some basic requirements to fight housing discrimination. Indiana is not alone in having legislation introduced."

Meanwhile, the Indiana Bankers Association in a statement applauded Pryor's efforts to address discrimination in mortgage lending and appraisals, but the organization is opposed to the bill advancing.

It views Pryor's bill as a duplication of federal law and expressed concern that it would create a new kind of civil liability for banks.

"The discriminatory lending practices this legislation seeks to prevent are already addressed (in large part using the exact same statutory language), by existing federal laws and regulations that all banks must comply with or face significant regulatory and civil liability," the association said in an emailed statement.

Contact IndyStar reporter Alexandria Burris at aburris@gannett.com or call 317-617-2690. Follow her on Twitter: @allyburris.

This article originally appeared on Indianapolis Star: Indiana bill aims to stop discrimination in home appraisals, lending