Industry Analysts Just Upgraded Their OncoCyte Corporation (NYSEMKT:OCX) Revenue Forecasts By 14%

Celebrations may be in order for OncoCyte Corporation (NYSEMKT:OCX) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts have sharply increased their revenue numbers, with a view that OncoCyte will make substantially more sales than they'd previously expected.

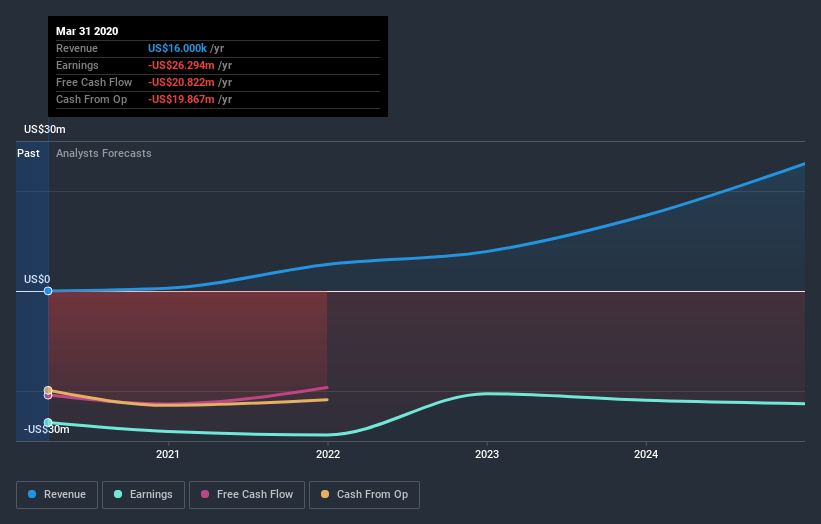

After the upgrade, the five analysts covering OncoCyte are now predicting revenues of US$571k in 2020. If met, this would reflect a sizeable improvement in sales compared to the last 12 months. Losses are expected to be contained, narrowing 11% from last year to US$0.42. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$499k and losses of US$0.43 per share in 2020. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

Check out our latest analysis for OncoCyte

Yet despite these upgrades, the analysts cut their price target 45% to US$3.30, implicitly signalling that the ongoing losses are likely to weigh negatively on OncoCyte's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values OncoCyte at US$7.00 per share, while the most bearish prices it at US$1.50. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely differing views on what kind of performance this business can generate. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

The Bottom Line

The most important thing here is that analysts reduced their loss per share estimates for this year, reflecting increased optimism around OncoCyte's prospects. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at OncoCyte.

Analysts are clearly in love with OncoCyte at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as a short cash runway. You can learn more, and discover the 3 other risks we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.