When Inflation Sticks Around

Inflation is rising quickly. And it might be here to stay.

The Fed said as much on Wednesday, conveying that it’s less confident this rise in inflation could just be temporary. On Friday, Fed governor Jim Bullard surprised investors when he insinuated that inflation could stick around through next year and force the Fed to raise interest rates.

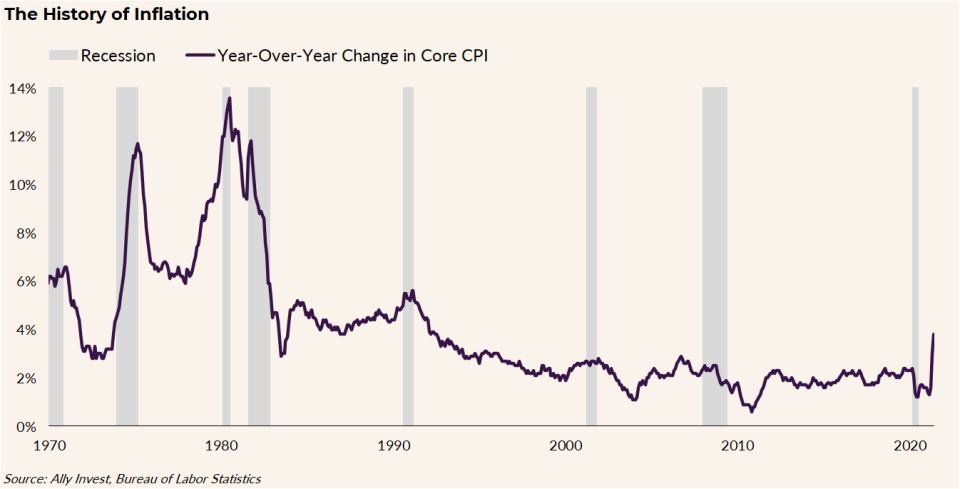

We’ve now seen two straight months of year-over-year core Consumer Price Index (CPI) growth of 3% or more, the first time that’s happened since the mid-90s. Of course, there are some base effects, and the drivers of recent inflation look like temporary quirks from supply chain issues and post-COVID dynamics.

But it may be time to start thinking about what a world of persistently high inflation looks like.

Inflation can be a tough trend to navigate. In the past, high inflation has led to economic recessions and lower stock returns.

Don’t let inflation scare you away from the markets, though. In fact, it’s more important than ever to stay invested and engaged.

Why? We’ll tackle this with a little bit of math.

The Value of Money

Grab your calculators. Here’s a crash course on the time value of money.

Prices in the U.S. have steadily risen over the past several decades. When prices are consistently moving higher, you may find that your paycheck doesn’t stretch as far as time goes on. That’s because inflation erodes the value of money over time.

Think about the dollar. A dollar bill may be worth $1 now, but chances are it won’t be worth a dollar in the future. Like any currency, it can lose value over time as inflation creeps up. If inflation rises 3%, $1 now would be worth 97 cents a year from now. Three cents may not be that much, but the impact of inflation can snowball as time goes on.

Let’s say you’re sitting on $100,000 in cash, and the inflation (discount) rate is 2%. In 10 years, that $100,000 today could be worth about $82,000. Bump that inflation rate up to 3%, and that $100,000 could be worth just $74,000 in 10 years.

The Power of Now

Your portfolio may be one of your strongest tools to fight inflation’s burden on your finances.

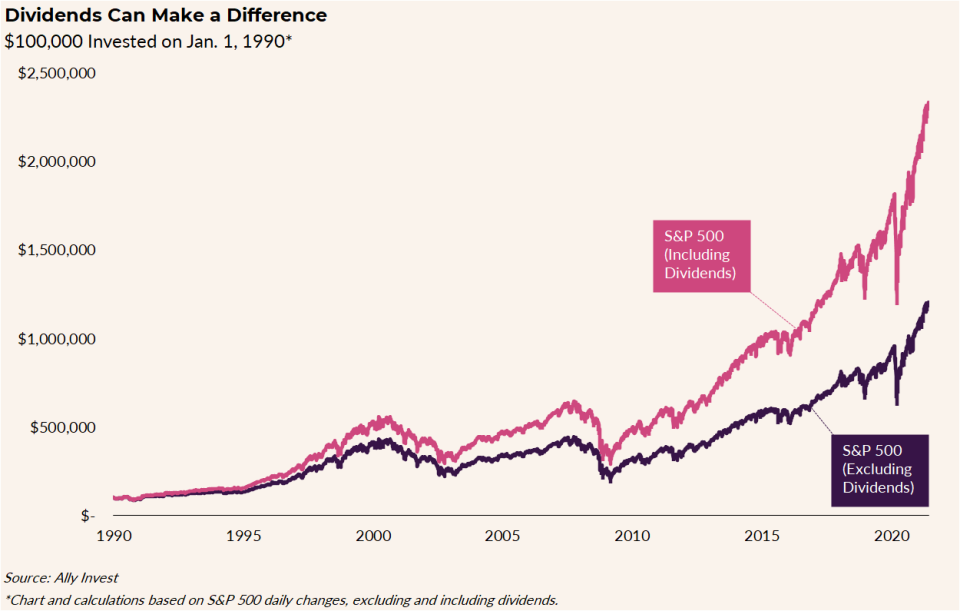

Stock market growth has historically overwhelmed inflation. In fact, the S&P 500 has grown an average of 8% a year since 1990. Compare that to core CPI’s 2% average annual growth over the same time period. That’s one reason why investing can help you build your wealth.

The catch? You have to start early and stay invested. Starting early is always wise, but it’s especially important when cash is losing its buying power in a high-inflation environment. Plus, you need to give your portfolio as much time as possible to reap the benefits of compounding and counteract the drag of inflation.

Easier said than done, though. Society and the markets are unusually bent on instant gratification. Your brain isn’t wired to think far into the future, either. There’s even a cognitive bias called hyperbolic discounting, which is when you ignore a larger long-term payoff for short-term rewards. The struggle is real.

To be fair, it’s wise to keep some cash on hand for emergency expenses and investing opportunities. But remember: Investing early may give your portfolio its best shot at success, even when inflation strikes.

Short-term vs. Long-term

You’ve started investing. Great. Now, let’s take it a step further.

There are several classic ways to hedge against rising prices, including cyclical stocks, gold, TIPS (Treasury Inflation-Protected Securities) and non-traditional assets. Of course, you need to take your individual needs and considerations into account as well.

But no matter where you look, it’s important to prioritize cash flow over growth potential when inflation is surging. Short-term payouts may actually help you maximize long-term growth. Sounds counterintuitive, but hear me out.

Think back to our lesson on the time value of money. When increasing inflation leads to higher rates, the present value of future growth (and money) is lower. High-flying stocks usually trade on the assumption of growth potential down the road, and higher inflation could reduce this potential. Growth has a place in the portfolio, but it may not shine as much now as it does in a low-inflation, low-rate environment.

Instead of waiting for a growth-focused stock to blossom, it may be worth checking out dividend stocks. While dividend payers usually aren’t the trendiest companies – toilet paper makers, food distributors and power companies – their payouts could help get cash back in your pocket sooner (at a presumably higher present value). And if you re-invest that dividend payment, you may be able to supercharge your portfolio’s growth over time.

You don’t have to look far to find dividends, either. About 76% of S&P 500 companies pay a regular dividend, and many of those pay one every quarter. Plus, stocks could give back even more money to shareholders after impressive profit growth this year. In fact, S&P 500 companies boosted their dividends by $20 billion last quarter, the biggest increase in nine years.

The Bottom Line

This bout of inflation may be temporary, and if that’s the case, it could just be a blip on the radar for the economy and the market. However, inflation can be a self-fulfilling prophecy, and Wall Street is coming around to the idea that this inflation surge may stick.

But inflation doesn’t have to doom your portfolio. It may even help you uncover some important opportunities to put your money to work. Let the math work in your favor: Think about how the time value of money can impact your investments, and be prepared to take advantage if the market slides on an inflation scare.

See more from Benzinga

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.