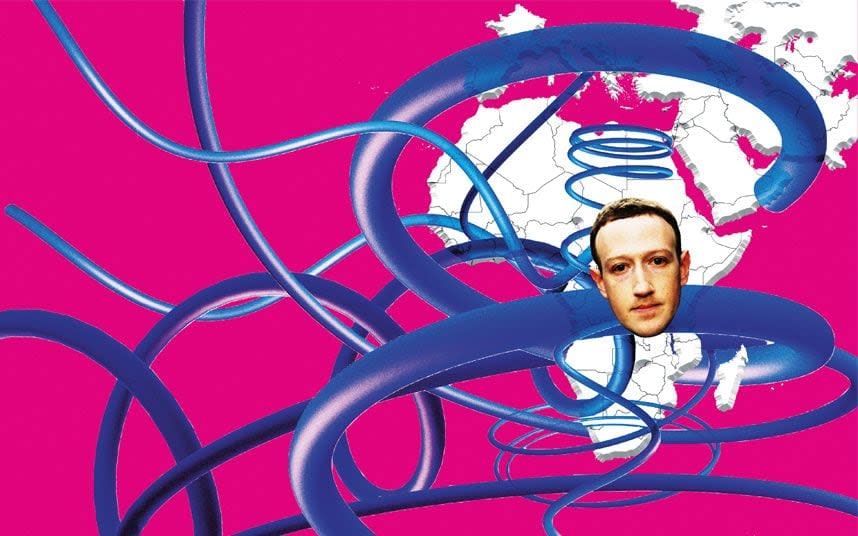

Inside Facebook's plan to bring cheap internet to Africa - by surrounding continent with undersea cable

Africa is looking like an increasingly promising place to do business. The International Monetary Fund expects it to come second behind Asia for economic growth this year. The continent is also second only to Asia in terms of population, with more than 1.2 billion people.

But there are big differences between Africa and Asia. In particular, Africa is the last major region where the internet has yet to arrive. Even in the tech-loving under-24 age group, fewer than half of Africans are online: this is not true on any other continent.

For some companies, this is a massive business opportunity. “At Facebook, we have a saying that we’re only 1pc done, and this couldn’t be truer for Facebook in Africa,” says Nunu Ntshingila-Njeke, Facebook’s first head of Africa.

Fewer than 13 per cent of Africans use Facebook, a uniquely low figure. The web giant doesn’t want to sell internet access: it has been very clear that it won’t become a telecommunications company.

Ntshingila-Njeke, as one would expect, has a background in advertising rather than telecoms. But it is very much in Facebook’s interest that internet access should be widespread, high quality and affordable.

Africa faces different internet obstacles to those seen in the West, where the story of internet access was mostly one of “last mile” connections to end users. Today, however, lots of Africans have smartphones and many can access mobile data.

Their difficulty is that African bandwidth is the most expensive in the world. Even for those who can afford it, the internet frequently breaks down across huge swathes of the continent. The underlying trouble in Africa is nowhere near the user, but in the backbone internet behind the telco or ISP.

All over the world, this network backbone is made up primarily of optical fibres, with key links generally running under the sea via submarine cables. It might seem that global connections aren’t needed for many local tasks, but in the modern internet era this is seldom true.

If one African Facebook user interacts with another, both of them need to be connected to a Facebook data centre. There are no Facebook data centres in Africa.

The problem with submarine cables is that they routinely get broken by storms, seismic events, fishing gear, ships’ anchors etc. This is rarely even noticed in the developed world, as there are many alternative routes. As an example, there are 16 cables linking Europe to North America.

In the developing world there are fewer undersea pathways. Back in 2008, just two breaks caused by a ship’s anchor took down the internet across the Middle East and India. Conspiracy theories still circulate regarding cable breaks that year, though nothing terribly unusual occurred.

Many new cables have been laid since then (as you can see in the timelapse graphic below), but only a few to Africa. Many coastal African nations have only one or two submarine cable landings.

The lack of competition is a major factor making African bandwidth expensive. Monopoly or duopoly suppliers can charge high prices – and often the organisation selling access to a cable landing is the nation’s incumbent telco, meaning that it may try to keep local rivals off the cable altogether.

As an example, in recent times when the South Atlantic 3 (SAT-3) cable was the only one in South Africa, it was reported that Telkom South Africa was quoting prices to its competitors for SAT-3 access that were actually higher than using satellites. Various people including Elon Musk are working on reasonably-priced satellite broadband with acceptable latency, but they aren’t there yet.

Telcos aren’t necessarily unhappy with a situation of high prices, of course. It was also reported at the time of the SAT-3 monopoly that South African ISPs were making 60pc of their revenues from reselling overpriced international bandwidth.

It was noticeable that investors in the Eastern Africa Submarine System cable (EASSy), which opened some years later, included prominent African mobile operators. Among them were Airtel (due to float in London on Friday), Vodafone subsidiary Vodacom and of course Orange, which claims one in 10 Africans as customers and continental revenues of €5.2bn (£4.6bn). Telkom SA is an EASSy owner, too.

The continent remains poorly connected and prices remain high, despite the telcos’ cable involvement. Facebook attempted to drill past the price barrier by paying telcos to provide its services, plus selected other parts of the web, to Africans for free: but this isn’t really an answer.

Any attempt to monetise the supposedly philanthropic “Free Basics” platform would surely attract even more criticism than the idea already has, and the telcos can shut it off at will. The general paucity of African cables also means weak redundancy and poor reliability: most cable landings are branches from just a handful of coastal main lines.

A particular issue is that Africa’s main cables run up and down the coasts but most don’t go around the Cape. This means that if one of Africa’s main coastal cables goes out, the countries south of the break can’t use it.

At the moment, most of the east African coast is served by only two main lines, as is much of the west. A fairly ordinary two-cable break could thus cut off an entire side of the continent. A single outage in the ACE (African Coast to Europe) cable last year caused disruption in 10 countries. All this might have been acceptable once, but things have changed.

Global international bandwidth use surged by 40pc every year from 2012 to 2017, according to TeleGeography. Most of this is caused not by end users, but by the swelling bandwidth requirements of the content and cloud providers.

Amazon, Apple, Facebook, Google and Microsoft are responsible for approximately 70 per cent of the increase, according to Cisco figures.

Major cloud providers need data centres around the world to serve customers. The prospect of such a centre being cut off from the wider network by an event as common as an undersea cable break – or even two – is unacceptable, as it needs to continually exchange massive amounts of data with the cloud’s other centres to keep functioning properly. Facebook with its colossal content delivery network operates in much the same way.

This has already led the web giants to get directly involved in the submarine cable business, upgrading the global backbone to meet the burgeoning requirements of their cloud networks.

Microsoft and Facebook built their MAREA (Spanish for “tide”) cable because the existing transatlantic cables mostly landed in a small area of the northeastern US seaboard, and Hurricane Sandy affected them all. Facebook has also partnered with Google on the new Pacific Light Cable from Los Angeles to Hong Kong. The cloud majors have been active in other recent projects.

Facebook and the other big cloud companies may be keen to do business in Africa, then, but Africa’s submarine cables are not up to the job. There are just two cloud data centres in all of Africa (both Microsoft, predictably in South Africa, one of the few African nations with reasonable undersea connectivity). And bandwidth prices for most Africans remain much too high for the web giants’ liking.

If it’s left to the telcos to build and own the cables, that situation may persist for a long time. So the recent news is that Facebook is in talks to build a new African cable that would “encircle the continent”. That would mean at least three cable options on each coast and the ability to route around the Cape, bringing better reliability.

Three sea routes is regarded as the minimum for a major data centre, so the proposed “Simba” cable would open up Africa for the internet giants at a stroke.

Facebook’s particular scheme may not go ahead, of course. It seems all but certain, however, that some such project will.