Inside a sprawling investigation into global finance, the safety net for rural Iowa insurers

During a story idea meeting of our business and investigations reporting team last summer, Tyler Jett was explaining the web of companies he had encountered as he investigated an out-of-state company that had emerged in Iowa’s rural property and casualty insurance market.

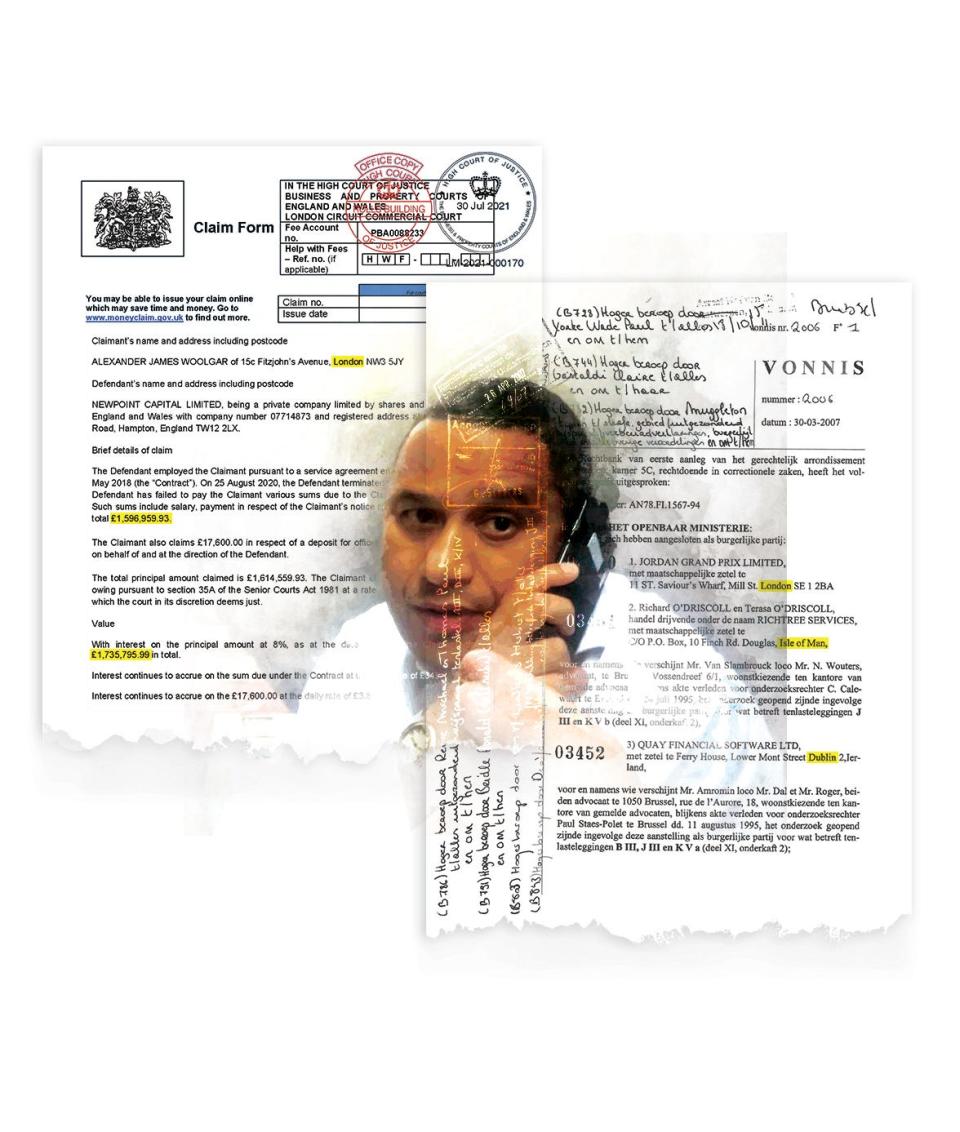

He stepped up to a whiteboard and with a red marker started hurriedly scribbling unfamiliar company names, in other states and countries, linked by lines and arrows. By the end, there were 10 companies and one set of initials: KB.

Little did he know then that his reporting would lead to a sprawling four-month investigation, published in three parts, tracing a tangle of companies, business liquidations and fraud accusations around the globe.

For Iowans, the heart of the matter is this: If a major storm strikes and their local mutual insurer needs to cover a lot of claims, will the mutual and its reinsurer have enough cash to pay them?

Tyler, who started at the Register as a business reporter and was promoted this year to investigative reporter, had been looking into the trouble that some of Iowa’s small-town mutual insurance companies were having in gaining reinsurance, which they are required to buy to help offset their risk. After expensive derechos in 2020 and 2021, reinsurers were declining to do business with some mutuals in Iowa.

Reporting finds a tangle of global business connections

When taking on a new topic, reporters often start by seeking to answer a basic question: How does this work?

Tyler called dozens of mutuals across Iowa and talked to managers and presidents. Someone mentioned that an Indiana firm, Mutual Underwriters, had arrived on the scene to offer reinsurance in Iowa. That led him to Jared Carlson, CEO of Heartland Mutual Insurance Association, a small, 136-year-old firm in Algona that was the first mutual in Iowa to go into business with Mutual Underwriters.

Carlson explained Heartland’s arrangement with Mutual Underwriters: It would manage his business, while Newpoint Reinsurance, on the Caribbean island of Nevis, would provide reinsurance coverage. So Tyler began looking into Newpoint Reinsurance, and found Securities and Exchange Commission filings for an associated publicly traded shell company in California, Newpoint Financial Corp. Those filings disclosed Newpoint had sued the Bermuda Monetary Authority after the authority blocked it from buying a reinsurance firm there.

“That seemed like a red flag,” Tyler said.

He looked up the executives listed in Newpoint Financial Corp.’s filings, which led him to articles in the Kenyan press that reported one of them, Keith Beekmeyer, the KB in his whiteboard scribblings, had been arrested there.

“That seemed like a second red flag,” he said.

Each connection led to another, and the more Tyler learned, the more questions he had.

In his internet sleuthing, he came upon an obscure Wordpress blog about insurance in London that mentioned Beekmeyer had been employed at Dai Ichi Kyoto Reinsurance. In an article in The Independent, a British online newspaper, an investigator called Dai Ichi the perpetrator of “the grandaddy of insurance fraud.”

Mutual insurers are bedrocks of rural business communities

Meanwhile, Tyler continued talking with Iowans. He had driven over to Lone Tree, population 1,350, in Johnson County to talk with Phyllis Peterson, who has worked for Lincoln Mutual Insurance Association for 39 years. She explained that the 150-year-old company, where she’s secretary-treasurer, faced 60% premium increases over a two-year period for its reinsurance after the storms of the past few years. The company would need to decide whether to pass the rate increases on to customers, sell the business or fold, Tyler reported last summer.

“Talking and visiting with Phyllis helped me appreciate the importance of these mutuals in small towns,” Tyler said.

He read up on the history of mutual insurers in Iowa, including a 2005 column by former Register business editor and columnist David Elbert.

The column “outlined how farmers in small towns started these mutuals in part because of their distrust of big East Coast firms that answered to shareholders,” Tyler said. “The mutuals are owned by policyholders, and they keep the money in the company instead of paying dividends to rich investors. This history actually explains why Iowa’s economy still relies on the insurance industry. Our biggest local player, Principal Finance Group, actually started as a mutual called Bankers Life Association.”

This investigation offers a preemptive warning to Iowans

Often, investigative reporting starts with a victim preyed on by the powerful and seeks to sort out what went wrong and who was responsible.

“This investigation is a bit odd, in that we’re looking into red flags before anything really happens in Iowa,” Tyler said. “Yes, the state worked to allow Mutual Underwriters to take over Heartland Mutual. And yes Mutual Underwriters has since tried to lure other Iowa mutuals. But so far, no one is out any money. Rather than exposing victims, this investigation is more a preemptive warning.”

Our hope is that Tyler’s reporting informs Iowans, insurance companies and state regulators about possible risks posed by this new entrant to Iowa’s insurance market.

Tyler continues to track down liens and other documents in the U.S. and overseas to flesh out Beekmeyer’s finances. Iowa Insurance Commissioner Doug Ommen has declined the Register's interview requests. An agency spokesman responded only to written questions.

Ommen owes Iowans a fuller explanation of what his division is doing to ensure that their interests are protected.

Carol Hunter is the Register’s executive editor. She wants to hear your questions, story ideas or concerns at 515-284-8545, chunter@registermedia.com, or on Twitter: @carolhunter.

This article originally appeared on Des Moines Register: Inside a sprawling investigation of Iowa insurers, global business deals