Insiders Roundup: ClearOne, Schrodinger

- By Tiziano Frateschi

The GuruFocus All-in-One Screener can be used to find insider trades from a specific period of time or for a certain range of values. For these stock picks, I went under the Insiders tab and changed the settings for All Insider Buying to "$2,000,000+," the duration to "September 2020" and All Insider Sales to "$2,000,000+."

According to these filters, the following were this past week's most significant trades from company insiders.

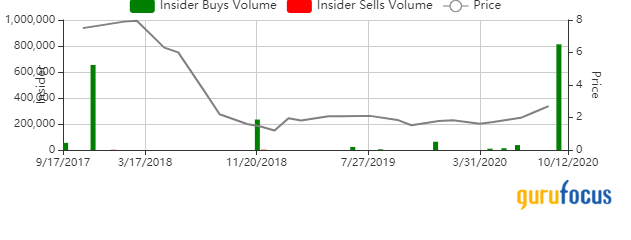

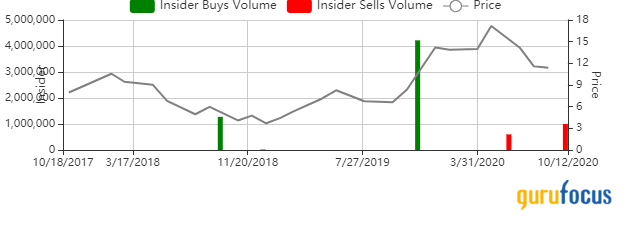

ClearOne

Edward D. Bagley, 10% owner, bought 802,408 shares of ClearOne Inc. (CLRO) for an average price of $2.49 per share on Sept. 16.

The communications solutions company has a market cap of $43.14 million. It has insider ownership of 51.87% and institutional ownership of 4.81%.

Over the past 12 months, the stock price has risen 37%, and as of Monday, shares were trading 26.83% below the 52-week high and 96.21% above the 52-week low.

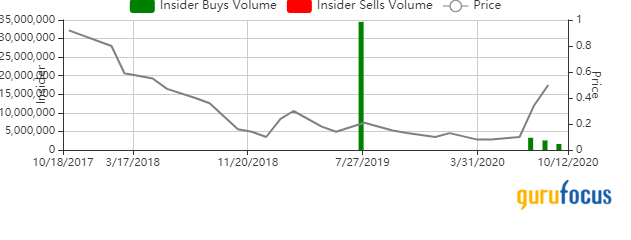

Rezolute

Handok Inc, 10% owner of Rezolute Inc. (RZLT), bought 250,000 shares on Sept. 17 for an average price of 46 cents per share.

The biopharmaceutical company has a market cap of $129.06 million, an enterprise value of $115.50 million and an insider ownership of 47.35%.

Over the past 12 months, the stock has climbed 300%. As of Monday, shares were trading 34.33% below the 52-week high and 609.68% above the 52-week low.

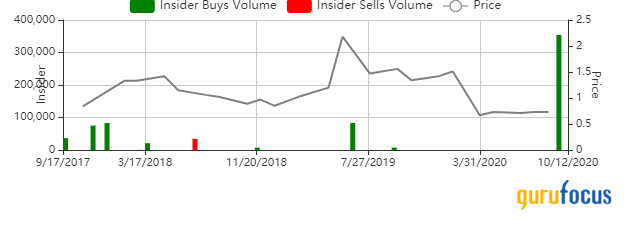

Charles & Colvard

Ollin B. Skyes, director, bought 258,004 shares of Charles & Colvard Ltd. (CTHR) for an average price of 78 cents per share on Sept. 16.

The company, which manufactures and distributes finished jewelry, has a market cap of $25.55 million and an enterprise value of $13.35 million. It has insider ownership of 21.74% and institutional ownership of 8.93%.

Over the past 12 months, the stock price has fallen 40.12%. As of Monday, shares were trading 46.86% the 52-week high and 47.03% above the 52-week low.

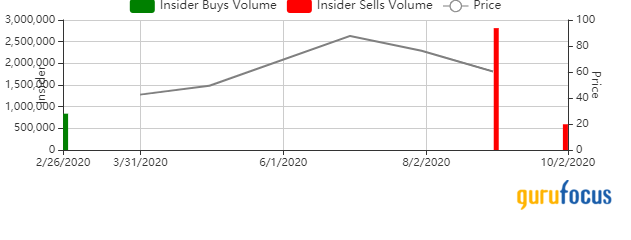

New Fortress Energy

10% owner NFE SMRS Holdings LLC sold 642,005 shares of New Fortress Energy Inc. (NFE) for an average price of $32.77per share on Sept. 17.

The integrated gas-to-power company has a market cap of $6.16 billion and an enterprise value of $7.03 billion. It has insider ownership of 0.49% and institutional ownership of 7.94%.

Over the past 12 months, the stock has gained 179.27%. As of Monday, shares were trading 6.63% below the 52-week high and 420.68% above the 52-week low.

Schrodinger

David E. Shaw, 10% owner of Schrodinger Inc. (SDGR), sold 573,889 shares for an average price of $53.06 per share on Sept. 17.

The healthcare-based software company has a market cap of $3.87 billion and an enterprise value of $3.60 billion. It has insider ownership of 1.23% and institutional ownership of 15.25%.

Over the past 12 months, the stock price has risen 95.71%, and as of Monday, shares were trading 43.67% below the three-month high and 12.01% above the three-month low.

Molecular Templates

Kevin M. Lalande, 10% owner, together with SHV Management Services, LLC, 10% owner, sold one million shares of Molecular Templates Inc. (MTEM) on Sept. 16 for an average price of $13.05 per share.

The company, which develops therapeutic agents that selectively target tumor cells, has a market cap of $615 million and an enterprise value of $549.49 million. It has insider ownership of 11.76% and institutional ownership of 22.53%.

Over the past 12 months, the stock price has risen 72.31%, and as of Monday, shares were trading 35.57% below the 52-week high and 101.97% above the 52-week low.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Cyclical Companies Trading With Low Price-Sales Ratios

5 Tech Companies Beating the S&P 500

5 Banks Popular Among Gurus

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.