Insiders Roundup: Uber, AutoNation

The GuruFocus All-in-One Screener can be used to find insider trades from a specific period of time or for a certain range of values. For these stock picks, I went under the Insiders tab and changed the settings for All Insider Buying to "$200,000+," the duration to "January 2020" and All Insider Sales to "$200,000+."

According to these filters, the following are this week's most significant trades from company insiders.

PBF Energy

Inversora Carso, S.A. de C.V. bought 212,000 shares of PBF Energy Inc. (PBF) for an average price of $29.68 per share on Jan. 22.

The petroleum refiner has a market cap of $3.46 billion, an institutional ownership of 74.02% and an insider ownership of 0.98%.

Over the past 12 months, the stock declined 17.59%. As of Friday, it was trading 22.04% below its 52-week high and 36.86% above its 52-week low.

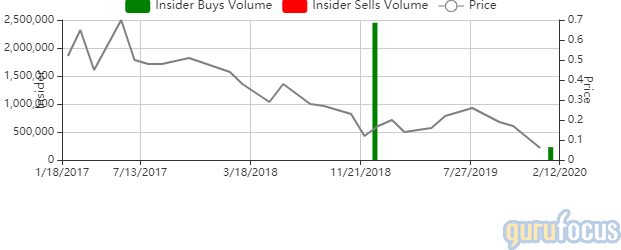

Synergy CHC

President and CEO Jack Ross bought 228,572 shares of Synergy CHC Corp. (SNYR) for an average price of 4 cents per share on Jan. 21.

The consumer health care company has a market cap of $5.43 million and an enterprise value of $10.23 million. It has institutional ownership of 20.59% and insider ownership of 0.67%.

Over the past 12 months, the stock has declined 73.91%. As of Friday, it was trading 79.17% below its 52-week high and 51% above its 52-week low.

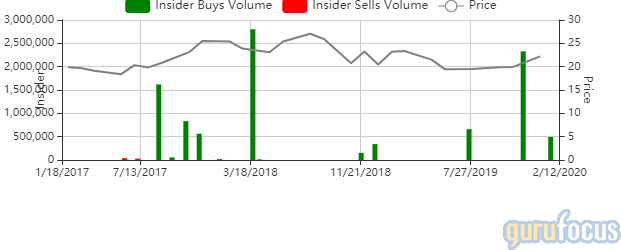

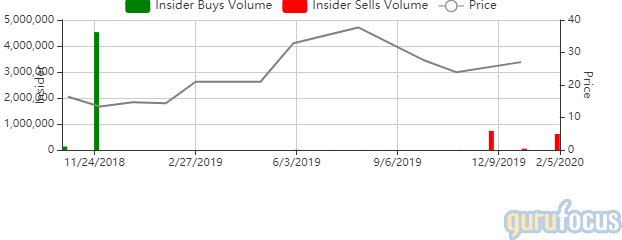

Trinity Industries

Bradon B. Boze bought a combined 372,066 shares of Trinity Industries Inc. (TRN) for an average price of $20.62 per share on Jan. 21.

The company, which provides products and services to the energy, transportation, chemical and construction sectors, has a market cap of $2.56 billion and an enterprise value of $7.50 billion. It has an institutional ownership of 99.54% and an insider ownership of 4%.

Over the past 12 months, the stock has declined 7.23%. As of Friday, it was trading 21.67% below its 52-week high and 30.13% above its 52-week low.

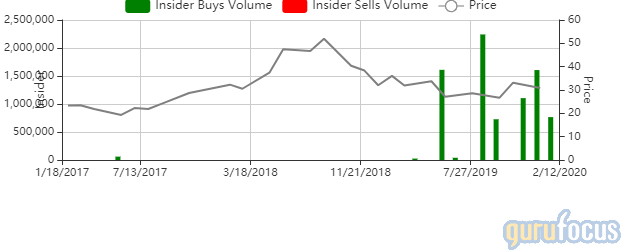

Uber Technologies

The Mastercard Foundation director of Uber Technologies Inc. (UBER) sold 510,000 shares for an average price of $37.23 per share on Jan. 23.

The ridesharing company has a market cap of $63.80 billion, an insider ownership of 2.07% and an institutional ownership of 54.9%.

Over the past 12 months, the stock has risen 10.03%. As of Friday, shares were trading 1.45% below the three-month high and 46.21% above the three-month low.

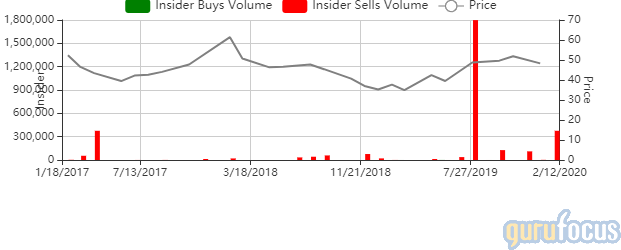

AutoNation

AutoNation Inc. (AN) 10% owner Edward S. Lampert sold 370,736 shares for an average price of $45.42 per share on Jan. 22.

The American automotive dealer has a market cap of $4.01 billion and an enterprise value of $6.24 billion. It has insider ownership of 0.97% and institutional ownership of 92.35%.

Over the past 12 months, the stock has risen 20.97%. As of Friday, shares were trading 15.40% below the 52-week high and 37.07% above the 52-week low.

Axonics Modulation Technologies

10% owner Andrea Partners and director and 10% owner Raphael Wisniewski sold a combined 600,000 shares of Axonics Modulation Technologies Inc. (AXNX) for an average price of $31.53 per share on Jan. 22.

The company, which operates in the medical devices and instruments industry, has a market cap of $1.05 billion, an insider ownership of 46.62% and an institutional ownership of 4.82%.

Over the past 12 months, the stock has climbed 107%. As of Friday, shares were trading 28.43% below the 52-week high and 121.71% above the 52-week low.

Disclosure: I do not own any stocks mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.