Do Institutions Own Molecular Templates, Inc. (NASDAQ:MTEM) Shares?

The big shareholder groups in Molecular Templates, Inc. (NASDAQ:MTEM) have power over the company. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. Companies that have been privatized tend to have low insider ownership.

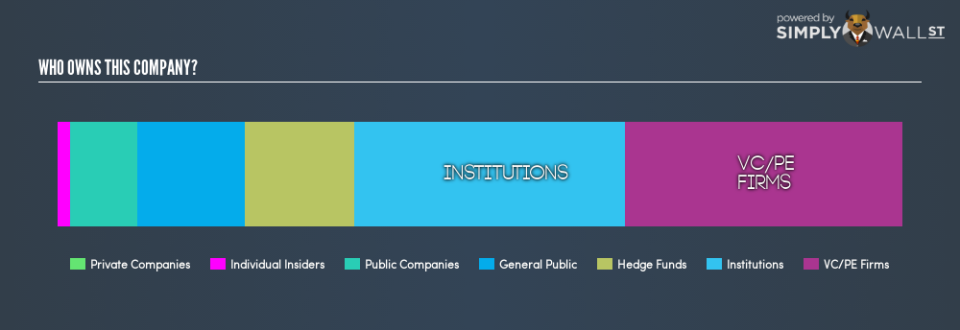

Molecular Templates is a smaller company with a market capitalization of US$164m, so it may still be flying under the radar of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions are noticeable on the share registry. We can zoom in on the different ownership groups, to learn more about MTEM.

See our latest analysis for Molecular Templates

Want to help shape the future of investing tools and platforms? Take the survey and be part of one of the most advanced studies of stock market investors to date.

What Does The Institutional Ownership Tell Us About Molecular Templates?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it’s included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

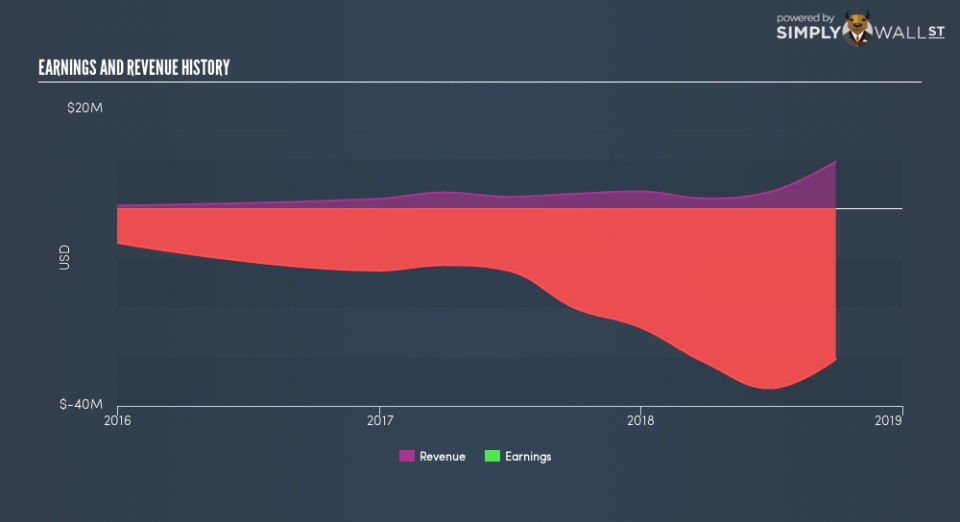

Molecular Templates already has institutions on the share registry. Indeed, they own 32% of the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there’s always a risk that they are in a ‘crowded trade’. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Molecular Templates’s historic earnings and revenue, below, but keep in mind there’s always more to the story.

It would appear that 13% of Molecular Templates shares are controlled by hedge funds. That catches my attention because hedge funds sometimes try to influence management, or bring about changes that will create near term value for shareholders. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Molecular Templates

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Shareholders would probably be interested to learn that insiders own shares in Molecular Templates, Inc.. As individuals, the insiders collectively own US$2.5m worth of the US$164m company. It is good to see some investment by insiders, but I usually like to see higher insider holdings. It might be worth checking if those insiders have been buying.

General Public Ownership

The general public holds a 13% stake in MTEM. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Equity Ownership

With an ownership of 33%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Public Company Ownership

It appears to us that public companies own 8.0% of MTEM. We can’t be certain, but this is quite possible this is a strategic stake. The businesses may be similar, or work together.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.