Insurance and aid aren't covering the cost of disasters in America. Is it time to relocate?

The shop on Main Street was supposed to be Chykeat Goodley’s ticket to the good life.

After 14 years of cutting hair and saving money, Goodley, 47, bought the three-story building in the small city of Norristown, Pennsylvania, planning to open a barbershop and lease out other suites.

That was in 2020. Then the pandemic delayed opening until March 2021. Six months later, the remnants of Hurricane Ida brought unprecedented flooding to Norristown and several feet of water into Goodley’s building, which he had spent a year renovating.

Goodley’s insurer told him his policy didn’t cover floods, which hadn’t seemed necessary before Ida – his building isn’t in a floodplain. A representative for the Federal Emergency Management Agency told him the disaster declaration for Pennsylvania didn’t mean aid for businesses. The only thing on offer was a low-interest loan.

He didn’t have time for that. Any delay would risk his tenants breaking their leases, an even greater fiscal risk.

Goodley said he threw $40,000 more of his savings and sweat equity into repairs: drywall, floors, HVAC, electric. It set him back years financially, but he feels fortunate to have reopened. Several other shops on the street remain closed four months later.

“At the time, I thought government would help out,” Goodley said. “But not one thing? Not a single penny?”

That outcome is one Americans face in growing numbers as climate change ramps up the destructive forces of nature. The financial mechanisms meant to help disaster victims – private insurance and government relief programs – have never covered all the costs of disaster, but the pain is multiplying as the number of costly disasters in the USA rises swiftly.

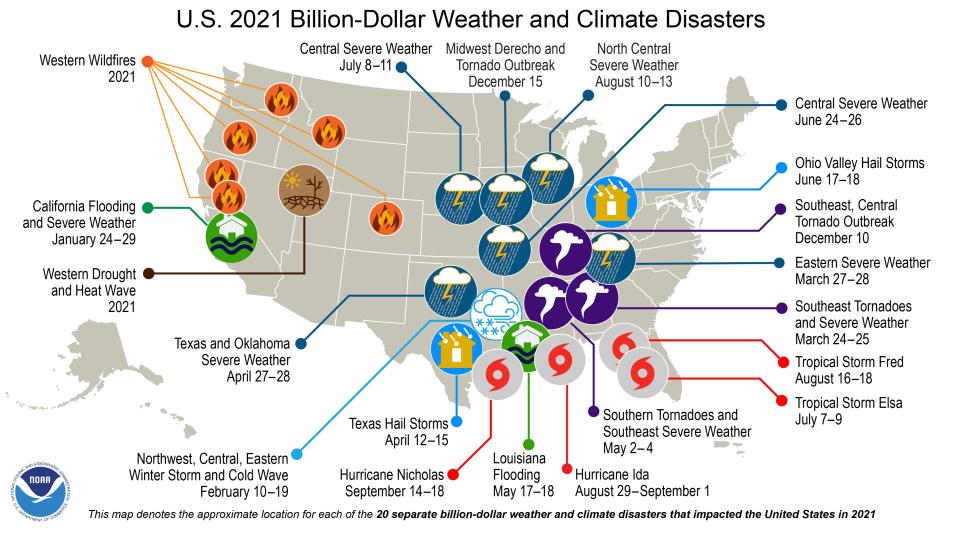

How swiftly? Last year, the National Oceanic and Atmospheric Administration counted 20 billion-dollar disasters, totaling $145 billion in damages, third-most of all time. The country had averaged about seven such disasters, adjusted for inflation, every year since 1980. In the most recent five years, the average spiked to more than 17.

The disasters also kill; they took the lives of 688 people in 2021, the most in a decade.

To what degree climate change is responsible is a matter of study. Scientists have linked global warming to many of the underlying conditions that contribute to dangerous weather events such as increased flooding, heat waves and droughts and more intense tropical storms and wildfires.

It’s not just major events such as Ida that are on the rise. Carolyn Kousky, a disaster finance expert and executive director of the University of Pennsylvania’s Wharton Risk Center, said smaller events, such as localized flooding, also drive up costs.

FEMA claims bear that out. From 1980 to 1984, its flood insurance program averaged annual payouts of about $89 million, adjusted for inflation. Costs have been rising ever since. In the past five years, the program has averaged almost $1.6 billion in annual payouts.

“There’s now widespread recognition that this isn’t a one-off thing, that we are on a trajectory of ever-increasing risk,” Kousky said. “We’re going to be seeing this and a lot worse in the coming years. This is not sustainable.”

When disaster strikes, there are typically four ways a home or business owner can recover, Kousky said: insurance, government relief, personal savings or a personal loan. Disaster relief was never intended to cover the full cost of damages. And full insurance and personal savings are out of reach for most Americans, especially in poorer communities.

“Savings and family aid are great for more affluent people, but a majority of Americans don’t have that kind of money to roll them through a disaster,” Kousky said. “Lower-income people struggle with all four of those sources. So they are the ones that are consistently, disproportionately harmed by disaster events.”

Experts said vulnerable households getting hit harder by natural disasters is a problem that needs addressing. What makes matters worse, said Jesse Keenan, a climate adaptation expert and professor at the School of Architecture at Tulane University, is that the increase in costly natural disasters is pushing beyond the country’s financial means to cope, from local governments to the federal budget.

If more money isn’t the answer, solving the problem will require politically fraught systemic changes, he said, such as identifying areas of high risk so development can be restricted and residents relocated, rather than using funds to constantly rebuild.

“There are a lot of political disincentives to dictate where people are going to live,” Keenan said. “But until we solve the land use problem, no amount of disaster relief is going to fill the gap.”

Insurance without assurance

On a Friday night in early December, Ben Ashby was watching a sunset and celebrating his 32nd birthday over dinner in Los Angeles when his phone began buzzing. Friends from back home in western Kentucky wanted to know: Was he in his cellar? Was he safe?

Two thousand miles to the east, a tornado had ripped through Walton Creek Valley, a strip of rural land where Ashby’s family has lived for generations. The tornado was one of several on Dec. 10 that caused $3.9 billion in damages and 93 deaths across four states.

Three days later, Ashby found his farmhouse standing but little else. A 120-year-old barn that his great-grandfather built was torn open, and other outbuildings were gone. An insurance adjuster told him the $60,000 in damages to his house would be covered but only about a third of $128,000 in damages to the barn and other structures would be paid out.

“One of them was my office,” Ashby said. “They haven’t even found all the walls of that yet.”

Still, Ashby counts himself among the lucky. Friends and neighbors lost their homes, and Ashby said many weren’t insured enough to cover the full costs of rebuilding. Some were told they may receive as little as 20%.

“It’s insult to injury, because you think you’re protected, and you think you’re covered, while you’re out searching for all your stuff in the fields, or you’re looking at your house with its missing kitchen,” Ashby said.

Experts who study the insurance industry said they understand those frustrations, but they point to an underlying, unfortunate truth: Many natural disasters are simply too expensive to fully insure.

“Will insurance, and even can insurance, ever completely provide coverage in a meaningful way for natural disasters? The answer to that is no,” said Donald Hornstein, a professor of insurance and environmental law at the University of North Carolina. “To do so would probably cause premiums to be so high as to be unaffordable.”

Hornstein said natural disasters such as tropical storms present “correlated risk,” which means they have the power to devastate wide swaths of policyholders, and thus wipe out insurance companies. That’s why private insurers almost never cover flood damage. After a string of huge losses in the mid-20th century, companies stopped covering floods, leading to the creation of FEMA’s National Flood Insurance Program in 1968.

That federally run program provides more than 95% of all flood insurance policies in the USA. It has been billions of dollars in debt since Hurricane Katrina struck in 2005, leaving taxpayers on the hook when Congress forgives the debt.

Many home and business owners remain uninsured or underinsured by the flood insurance program. Residential coverage maxes out at $250,000, even though the median home sales price in the USA eclipsed $400,000, according to federal data.

Insurance companies often exclude other types of disasters, such as mudslides and earthquakes. In the West, companies increasingly drop coverage of wildfires.

Officials in California, whose 8.7 million insured homeowners make it the largest residential market in the nation, have tried to slow the exit of private insurers in the wake of wildfires. When the entire town of Paradise burned in the deadly Camp Fire in 2018, major insurers canceled residents' policies within weeks.

A state law has since barred companies from canceling customers living in or near a governor-declared wildfire emergency for a year. But companies are free to stop renewing policies once the contracted term expires.

Even though wind events, such as the tornadoes in the U.S. heartland in December, are often covered by insurance, policies can fail to make people whole. Hornstein said the insured value of a home specified in many policies may not meet the real-world costs to rebuild it, especially after hikes in the costs of building materials and other inflationary pressures.

“Realistically, how many of us ever go back to our agents to update the insured value of our house regularly?” Hornstein said. “It’s easy enough to lecture people, but I haven’t done it, and I’m an expert.”

Disaster relief funds fail to fill gap

Tiffany and Akira Shimbo were at work on Zoom calls Dec. 14 when they heard a roaring crash outside their home in California’s Silverado Canyon, a sylvan outpost 45 miles southeast of Los Angeles. Akira ran outside and saw a wave of fast-moving mud and water topping their fence and shoving their Jacuzzi, garden beds and more into raging Silverado Creek below them.

“It sounded just like a car accident, only over and over,” Tiffany Shimbo said.

Tiffany pulled Akira through a window to safety as floodwaters and debris flows raged on three sides of their home. They waited three hours until the waters receded. The house stood, they and their 5-year-old daughter were alive, but they soon learned that neither insurance nor government disaster relief programs would help them.

Debris flows, often called mudslides, are a growing problem in the wildfire-scarred West, where rivers of mud, boulders and charred logs from burned hills can crash into homes during heavy rains.

In 2020, about 6.5 million acres across Arizona, California, Colorado, Nevada, New Mexico, Idaho, Oregon, Utah and Washington were at risk of the flows. But many homeowners' policies specifically exclude flood and mudslide or debris flow damage.

The Shimbos’ insurance claim was denied because they bought their property after the wildfire that created the mudslide conditions. There was no local or presidential disaster declaration to unlock public relief funds. Orange County Supervisor Don Wagner, who represents the canyon, told USA TODAY that county attorneys viewed the neighborhood debris flows as a private problem, not warranting the use of taxpayer funds beyond clearing public roads. A California emergency declaration means the supervisors may clear creeks and culverts with federal and county funds, but no dollars will go directly to residents.

The Shimbos said they are $15,000 in debt from grappling with 10 feet of mud and growing mold under their home and face at least $75,000 in costs. They leaned on neighbors and nonprofits to nail tarps and plywood to their home to seal out the elements and dig out the mud. A friend started a GoFundMe for them.

Other neighbors are stuck with bills as high as $200,000 to repair homes and foundations. The experience left the community questioning the role of government to respond to natural disasters.

“We need to redefine, what is government responsibility?” said Linda May, a longtime Silverado resident who is a former FEMA local fiscal chief. “The saddest thing, which I’ve heard so much on this disaster, is ‘Who’s gonna pay for it?’”

Experts warned that even under the best circumstances, government relief programs won't make residents whole. Individual assistance through FEMA maxes out at about $37,000 for home damages. Other FEMA programs offer greater sums to rebuild infrastructure such as schools, roads and flood control measures, but they take years.

Using public funds to try to rebuild can lead to wealth inequities, said James Elliott, chair of sociology at Rice University. Research he performed with colleague Junia Howell shows that 15 years after a disaster, the wealth of white families increases more than it would have had the flood or fire never occurred, while the wealth of families of color decreases more than otherwise expected.

“We expected that people of color and those with lower income and renters would suffer,” Elliott said. “But what we didn’t expect was that those who were on the other side, more privileged and especially white … actually gained over time.”

One reason, Elliott said, is that disaster relief funds often go to homeowners, particularly those who have insurance. That leaves out renters and the uninsured, who typically have lower incomes and are less likely to be white.

Those with money and privilege are more likely to have time and resources to navigate the public relief application process. Zack Rosenburg, co-founder of SBP, a national nonprofit focused on disaster recovery and resiliency, said FEMA can do much more to clarify its application requirements and work to ensure funds are distributed equitably.

“It’s a process that ... drives attrition by being cumbersome and complex,” Rosenburg said.

Anne Bink, associate administrator for FEMA’s Office of Response and Recovery, said the agency is working to improve.

FEMA has expanded the types of documentation it accepts to verify homeownership or rental status, a hurdle Bink said can affect families whose homes have passed down through generations. The change resulted in an additional 41,000 people being accepted for relief monies in 2021. The agency also changed its calculations for when to provide direct housing assistance, adding 1,500 to the rolls.

The agency works with the U.S. Small Business Association to streamline application processes, Bink said. A pilot project allowed 23,000 applicants to access assistance who otherwise would not have.

“We see this as a culture shift,” Bink said. “We know we have more work to do. We want to build on our successes, and we want to continue to keep equity in the forefront of everything we do for survivors.”

Something better

Experts acknowledged that although there are ways to improve the country’s insurance and disaster relief programs, a holistic solution to the onslaught of climate change will require something bigger: getting out of harm’s way.

Kousky, the insurance expert at UPenn, received a grant from the National Science Foundation to help pilot an alternative insurance model in New York City. It will finance a community organization to quickly deliver small amounts of money – say $5,000 – to low- and middle-income residents in the event of flooding, which would ease immediate burdens for many.

Rosenburg sees potential in offering bridge loans to homeowners to begin rebuilding, to be repaid when government funds become available.

Experts said financial systems simply can’t cover the growing costs of disasters, and neither should they. Historically, about half of the money paid out under FEMA’s national flood insurance program – more than $12.5 billion as of 2016 – went to rebuilding properties that repeatedly flooded, according to Pew Charitable Trusts.

Officials from city councils up through Congress should implement policies that disincentivize or even restrict building in floodplains and areas prone to wildfire, experts said. Instead of paying to rebuild, they should pay to move people out of those areas after disaster strikes.

A bipartisan infrastructure bill that was signed into law late last year provides about $50 billion in climate resiliency funding, the largest such investment. Hornstein said the funds will boost FEMA’s efforts to relocate homeowners from floodplains or possibly elevate their homes and help pay for other flood mitigation projects.

The money is “a drop in the bucket,” Hornstein warned.

“The $50 billion is historic, and it’s simultaneously nothing,” he said. “The amount of money that actually needs to be spent is in the hundreds and hundreds and hundreds of billions.”

Contributing: Dinah Voyles Pulver, USA TODAY, and Cheri Carlson, Ventura County Star

This article originally appeared on USA TODAY: As climate change disasters rise, insurance, aid programs fall short