Insurance on NC beach rentals is going up again, potentially by a lot. Here's why.

If you own a second home at the beach or an investment property, prepare to take another hit in the pocketbook.

Less than eight months after raising insurance rates on rental properties by a statewide average of nearly 10%, the group that represents the state's insurance industry wants to increase the cost of new and renewing policies by more than half starting next summer.

The N.C. Rate Bureau has filed with the N.C. Department of Insurance to increase dwelling insurance rates for second homes by an average of nearly 50%. Extended coverage for buildings and contents would go up nearly 60%, while fire coverage would go up an average of 16%. Dwelling insurance policies, which aren't homeowner insurance policies, are offered to non-owner-occupied residences of a maximum of four units. That list includes rental and investment properties.

Generally, second homes tend to be seen as riskier properties to insure by insurance companies, especially if they’re going to be vacant most of the time or they’re in areas that are prone to natural disasters. That's true for the state's coastal areas, which would are proposed to see much higher increases than inland areas.

WEATHER WOES Study says climate change could impact the rapid growth along the NC, SC coasts

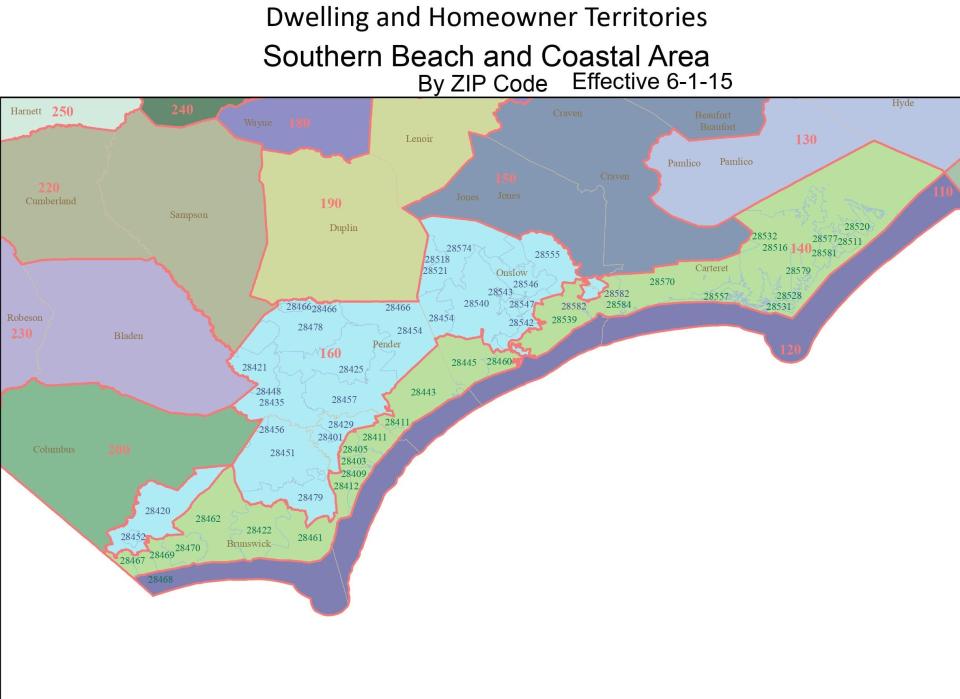

While rates statewide would rise by more than half under the rate bureau's plan, they would increase much more near the coast. The proposed increases for extended coverage in "Territory 140," which covers beach and coastal areas in Southeastern North Carolina, would go up more than 97% for buildings and 70% for contents. The biggest hike for extended coverage would be seen in Lenoir and Duplin counties, which would see 106% increases for buildings and 78% percent for contents.

The rate bureau has proposed the new increases come into effect in June 2024, but it is highly unlikely Insurance Commissioner Mike Causey won't negotiate a settlement on the filing with the insurance companies. He also has the option to deny the filing, which would result in a hearing being held.

But either way, it's obvious rates are going up. The last time the rate bureau made a dwelling rate filing was in August 2022, when it requested an average statewide increase of 42.6 percent. The final result, after negotiations with state regulators, was an increase of 9.9%.

"The approach in this filing is consistent with prior property filings of the bureau," said Paul Erickson, principal of actuarial consulting at New Jersey-based Insurance Services Office (ISO), in testimony presented with the rate bureau's most recent application. "Premiums should equal expected losses, plus expected expenses, plus a margin for a fair and reasonable profit."

Rising cost of living in 'paradise'

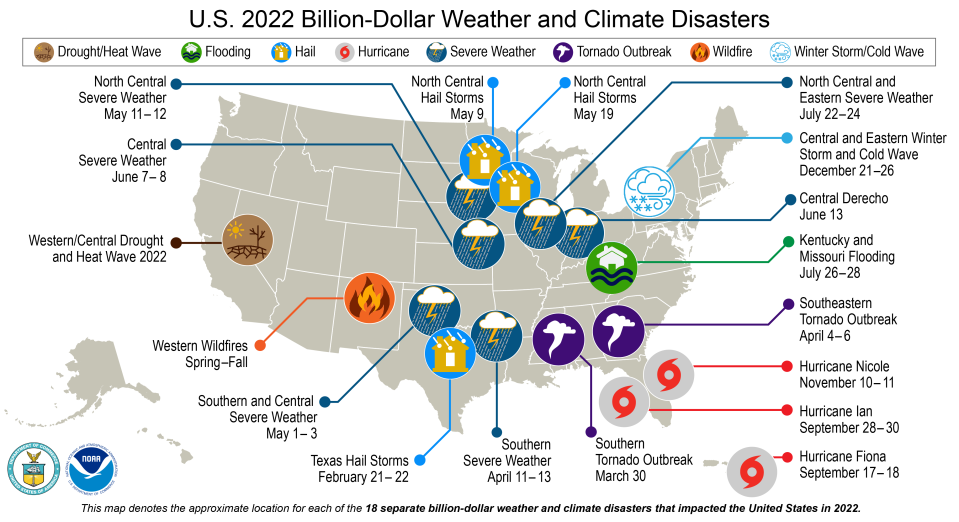

While the proposed increases might leave property owners with sticker shock, it marks the continuing trend of living at the coast getting more and more expensive as companies move to limit their exposure to natural disasters like hurricanes and flooding in a world where the weather is increasingly influenced by climate change.

"The long-term economic risks associated with climate change have rapidly moved to the forefront for banks and policymakers," states a recent Moody's Analytics report on which U.S. cities' economies are most at risk to climate change impacts over the next 30 years. According to the study, the six U.S. metro areas with economies most exposed to acute hazards are all in the Carolinas: Jacksonville, New Bern, Myrtle Beach, Wilmington, Greenville and Charleston.

COST OF COASTAL LIVING Plan to assess risk of climate change on insurance, including in NC, courts controversy

Along with increasing homeowners insurance and wind and hail rates, rates for flood insurance offered by the National Flood Insurance Program − since most private insurers won't offer policies due to the massive potential exposure − are rising quickly as the federal government moves to a risk-based approach in determining premiums.

Yet people are still moving in droves to coastal areas, even as climate change is predicted to amplify the hazards these areas face. The population of New Hanover, Brunswick and Pender counties − the Wilmington metropolitan statistical area (MSA) − is forecast to increase from 450,000 in 2020 to more than 625,000 by 2040. Coastal areas of South Carolina and Georgia and much of Florida are forecasting similar populations booms in coming years.

Rising home values

Along with that increased risk, the surge in popularity of areas like Southeastern North Carolina is fueling dramatic property value increases − further increasing the cost of insuring them.

Using data from the real estate website Zillow, the online data website Stacker determined that Wrightsville Beach was the North Carolina community with the fastest-growing home prices. The site said home values in the popular New Hanover County beach town averaged nearly $1.35 million in March 2023, with prices up 8.6% over one year and 82% over five years. Within the list's Top Ten, Topsail Beach came in at No. 3, Bald Head Island No. 4, Holden Beach seventh, St, James eighth, and North Topsail Beach ninth.

North Carolina isn't alone in facing this confluence of factors rattling its insurance market. In some other states, notably Florida and Louisiana, several insurance companies have gone bankrupt or left the market in the wake of severe losses tied to the recent rash of hurricanes hitting the Gulf Coast. California also is seeing this trend, as fears of climate change making the state's wildfires worse in coming years prompted State Farm and Allstate to stop selling new homeowner insurance policies.

RISING SEAS, RISING RATES Why what happens in Florida doesn't stay in Florida: What Ian means for NC insurance rates

The loss of private insurance companies offering policies has prompted several states to create property insurance plans that provide coverage to individuals or businesses that are unable to obtain insurance in the regular market. These programs, which includes North Carolina's "beach plan" in coastal areas and "FAIR plan" in other parts of the state are supposed to be a "market of last resort." If damages overwhelm the plans' reserves, the state has the right to implement a special assessment on all state homeowner policies to cover the additional costs, which could further destabilize the market.

But they have become the de factor insurers for some forms of insurance, notably windstorm and hail, as companies don't believe the rates they can charge cover their exposure risks. That's also true for dwelling insurance policies along the coast. In his testimony, ISO's Erickson noted that 96% of dwelling premiums in beach areas were written by the "beach plan" in 2021, while 80% of the dwelling premiums in other coastal areas were written by either the "beach" or "FAIR plan."

The more insurance companies have to pay in claims also means the more they have to pay for their own insurance policies, known as reinsurance. Those higher costs are then passed on to customers in the form of higher premiums.

Comment on the rate bureau's recent filing will be accepted through August 25, 2023 by emailNCDOI.2023DwellingandFire@ncdoi.gov or in writing to Kimberly W. Pearce, Paralegal III, 1201 Mail Service Center, Raleigh, N.C. 27699-1201

Reporter Gareth McGrath can be reached at GMcGrath@Gannett.com or @GarethMcGrathSN on Twitter. This story was produced with financial support from 1Earth Fund and the Prentice Foundation. The USA TODAY Network maintains full editorial control of the work.

This article originally appeared on Wilmington StarNews: NC insurance companies want huge rate increase for rental properties