Insurers must pay small businesses for lockdown losses, court rules

Hundreds of thousands of struggling businesses hit by coronavirus restrictions including bars, restaurants and nail salons could be entitled to a payout following a landmark court ruling.

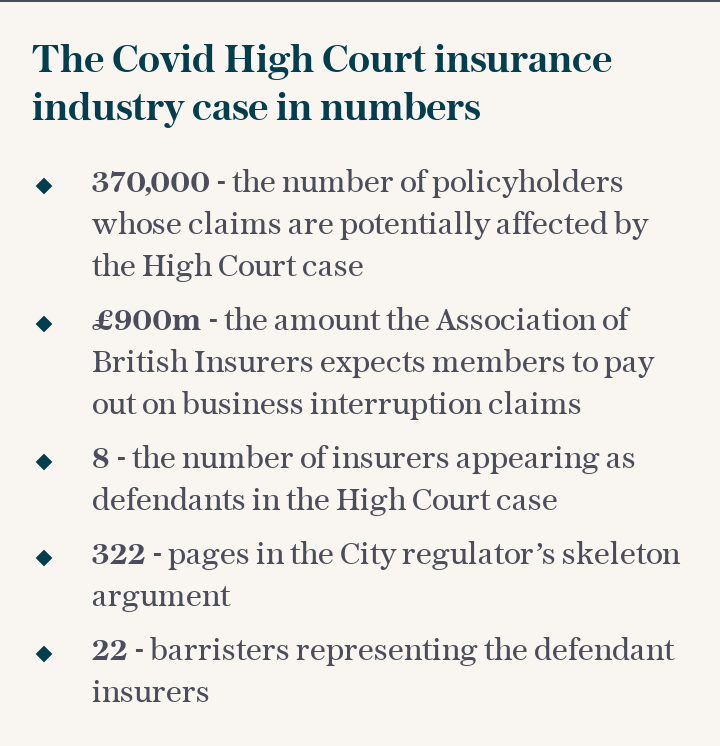

In a closely watched £1.2bn legal battle that began last year, cash-strapped businesses with business interruption insurance policies have been demanding payouts for heavy losses suffered when they were forced to shut during the first lockdown.

Insurers argued that most policies were never intended to cover losses caused by a global pandemic.

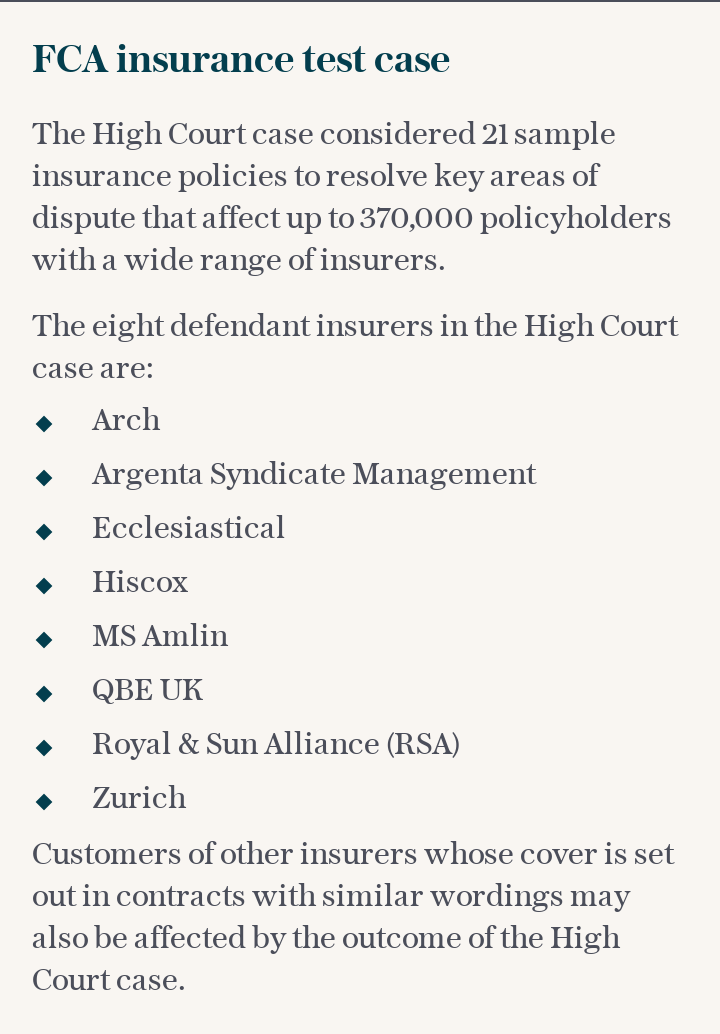

However, the Supreme Court has now "substantially allowed" an appeal brought by the Financial Conduct Authority on behalf of the companies, potentially affecting up to 370,000 firms holding 700 types of policies issued by 60 insurers.

Not all of these policyholders will be eligible for a payout. Lawyers said the ruling could however affect less conventional businesses, such as landlords, though it will depend on the type of policy they have.

The ruling could cost insurers hundreds of millions of pounds, with Hiscox estimating a claims hit of $48m. Huw Evans, head of insurance trade group the ABI, said "valid claims will be settled as soon as possible".

The City watchdog brought the case after a flood of claims following last spring's national lockdown triggered concerns over who was eligible.

Most business interruption insurance policies are focused on property damage but some also cover for infectious diseases and public authority closures, leading to some confusion.

The Government first ordered businesses to close last March. Lawyers for the FCA attacked the insurers’ argument that many firms’ losses were not covered because they had already shut voluntarily after the initial advice for people to stay at home.

They also argued that the "disease" clauses in the representative sample of policy types provided cover in the circumstances of the coronavirus pandemic, and that the trigger for cover caused policyholders’ losses.

Research from the British Institute of Innkeepers last May found that just 3pc of pub operators had successfully made a claim under a business interruption policy.

The High Court ruled largely in favour of the FCA in September, but because the two sides were unable to reach an agreement they made "leapfrog" appeals - bypassing the Court of Appeal - directly to the Supreme Court.

Murray Pulman and his daughter Emily were among the business owners who told The Telegraph last year that they were hoping the court would help them win a payout and keep trading.

The pair run the Posh Partridge Café in Dorchester, Dorset. They were denied a payout by insurer QBE despite having to close from March 18 to July 4, cancelling £8,000 worth of orders in the first week.

Herbert Smith Freehills lawyer Paul Lewis, for the FCA, said the outcome for businesses had improved "significantly" compared to last September's High Court judgment, which found that insurers were not liable under some of the most disputed contracts.

"Also for the insurance industry the judgment brings definitive guidance to how business interruption insurance wordings should operate in the context of the Covid pandemic," he said.