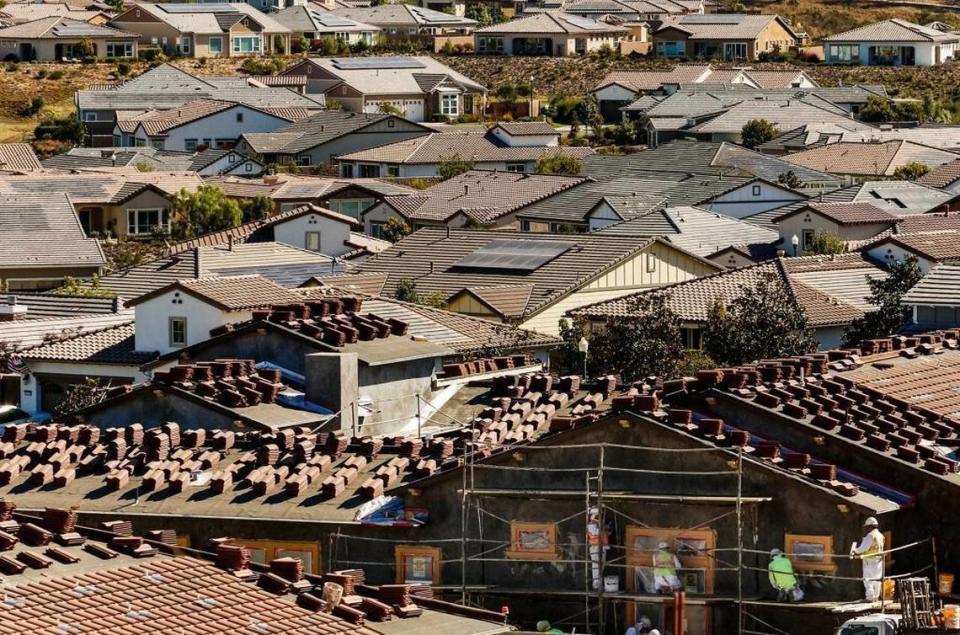

Interest rates hit highest point since 2000. How is it affecting SLO County home buyers?

As interest rates hit their highest point in September since 2000, squeezing home sales across California, San Luis Obispo County’s housing market held steady.

That’s according to the California Association of Realtors’ monthly housing data summary.

Home sales across the state fell for the fourth straight month in September, though the median price crept upwards slightly, the report found.

According to the report, that combination of factors has led to less competition in the California market in recent months, largely because more new home buyers cannot afford the high monthly rates.

But in San Luis Obispo County, interest rates were less of a factor for home buyers in September than they were for the rest of the state, Haven Properties Realtor Robin Mitchell-Hee told The Tribune.

“People are still coming into this community from the bigger metropolitan markets — the Bay Area, Los Angeles, San Diego (and) Southern California,” Mitchell-Hee said. “They’re selling their homes for more in those markets. They’re coming here for quality of life, and this market is still very affordable for them. We’re just still seeing a steady inflow of buyers.”

Interest rates hit new peak

In September, interest rates for a 30-year fixed-rate mortgage ended the month at 7.31%, and later reached a higher peak of 7.57% on Oct. 19, according to Freddie Mac.

September’s peak was another new high for interest rates, marking the highest rate since 2000, according to Freddie Mac.

Interest rates have not been lower than 7% since the start of August and have not dipped below 6% since September 2022, marking a full year of continued high rates, according to Freddie Mac.

For the most part, Mitchell-Hee said, San Luis Obispo County’s housing market has been immune to the effects of high interest rates, though recent rate spikes over the past two months have stalled home sales somewhat, she said.

However, Mitchell-Hee said, buyers appear willing to accept high interest rates for now with hopes of refinancing their mortgages down the line.

That means compromises for buyers looking to settle in San Luis Obispo County, she said.

“When the interest rate was lower, (buyers) could afford one type of home that probably had nicer upgrades, more square footage or a little bit bigger backyard,” Mitchell-Hee said. “When the interest rates were lower, (buyers) could afford a home in San Luis Obispo if they worked here. ...

“With interest rates changing, maybe they end up purchasing in one of our outlying communities, because then they can have a little bit more of a home but now they have a little bit of a commute.”

Home prices hold steady in SLO County

According the report, median home prices remained relatively steady in September in San Luis Obispo County.

The county’s median home price rose by 1.5% in September compared to the same time in 2022, and rose by 2.19% from August, for a September median of $880,000.

Sales were largely depressed across the state, with San Luis Obispo County registering 185 sales in September, 17% fewer than the previous year.

Available listings registered a slight 0.5% improvement year-over-year, with 386 units for sale in the county in September.

San Luis Obispo County’s neighbors saw far larger fluctuations in median price, listings and sales.

Monterey County’s median price of $943,000 was 14.7% higher than last September, and 10.5% higher than August’s median.

That price hike was accompanied by a 20% year-over-year decline in sales, with 152 in September, and a 25.3% decline in listings, with 286 units available in September.

In Santa Barbara County, the price fluctuations were more pronounced, with its median price of $1.03 million sitting 13.8% higher than September 2022, but 22.2% lower than in August.

Santa Barbara County’s 26% year-over-year decline in sales resulted in 145 transactions in September, though listings only fell 4.7% year-over-year to 326.

Statewide, the median price dipped 1.9% from August’s median of $859,800 to $843,340, though this price was 3.2% higher than September 2022’s median.

According to the CAR report, that trend is expected to continue through the end of 2023, with year-over-year prices projected to rise amid low inventory.

Sales fall back to earth while local prices fluctuate

Within San Luis Obispo County, prices, sales and listings fluctuated heavily depending on location within the county.

The city of San Luis Obispo paced all cities with a median price of $1.08 million in September, the report said.

This price was 9.5% lower than in September 2022 and 1.8% lower than August.

The price decline was accompanied by a 30.4% year-over-year bump in sales, with 30 transactions last month, while listings stayed identical to September 2022 with 38 in total.

In the North County, Atascadero experienced the largest median price hike between August and September, with prices rising 26.1% year-over-year and 43% month-over-month to $977,000, though this month-top-month jump was likely due to the low number of transactions.

In September, 13 homes were sold in Atascadero, a 51.9% decline from the previous year. There were 41 units on the market, 2.4% less than last year.

Paso Robles posted a median price of $754,000 in September, 4% higher than in August and 23.6% higher than this time last year.

In September, 42 homes were sold in Paso Robles, 2.4% more than the previous September, and 73 homes were available, 7.6% fewer than last year.

Templeton was the only North County city to register a month-over-month price decline, falling 10% from August to $900,000 in September, though this was 12.6% higher than the September 2022 median.

Sales also fell by 25% year-over-year in Templeton, while listings fell 20% to 20 over that time frame.

On the North Coast, prices were largely consistent month-to-month, with Morro Bay’s median price of $1.07 million leading the way.

Prices in Morro Bay rose 16.8% year-over-year, but fell by 10% from August.

In September, 14 homes sales were recorded in Morro Bay, 75% more than in September 2022, with 13 listings on the market, a 23.5% decline from last year.

Nearby, Los Osos recorded a median price of $810,000 in September, which was 21.1% lower than in September 2022 and 4.5% lower than August’s price.

Sales recorded in Los Osos also fell, declining 21.4% year-over-year to 11 last month, and listings declined 43.8% from last September to just nine last month.

Cambria homes were valued at a median of $916,000 last month — 23.7% lower than last year and 12.6% higher than August.

Just nine homes were sold in Cambria last month, 10% fewer than the previous September, while 31 properties were listed for sale, a 34.8% year-over-year gain.

In the South County, Pismo Beach’s median home price fell by 30.8% year-over-year and 8.7% month-over-month, declining to $899,000.

Sales were up 2.4% year-over-year in Pismo Beach in September, with a total of seven transactions, while the 25 available listings that month represented a 150% year-over-year bump.

Neighboring Grover Beach experienced a 1.9% year-over-year price decline to $770,000, which was 6.6% lower than the previous month’s median price.

Sales fell 57.1% year-over-year to just nine last month, while the 13 available listings were identical to the previous year.

Inland, Arroyo Grande posted the highest median price in the South County at $1.06 million, which was 2.5% lower than this time last year and 9.8% higher than the previous month.

Sales grew by 9.1% in September with a total of 24, while listings grew 23.1% year-over-year for a total of 32.

Nipomo saw its median price decline by 21.8% year-over-year and 21.4% from August, ending the month at $825,000.

Sales in Nipomo declined by 50% from last September to 13 last month, while listings declined more moderately by 12.5% for a total of 28.

What should local buyers do?

Mitchell-Hee said waiting out the high interest rates may not be the money-savvy move some buyers think it is.

Declines in sales and maintaining a similar amount of inventory over time happens when high interest rates discourage buyers from entering the market, she said.

If enough buyers wait for lower rates, that means there will be a “frenzy” of sales and new listings once rates become more acceptable to more buyers, Mitchell-Hee said.

Mitchell-Hee said buyers shouldn’t hold their breath for rates to return to levels seen before the height of the COVID-19 pandemic.

Instead, she said, those shopping for a new home should work with real estate agents to buy sooner rather than later.

“They’ll have a lower interest rate, but then they’ll have a higher purchase price,” Mitchell-Hee said. “It would be really ideal for buyers to just go ahead and buy now and build into their offer a seller credit to buy down their interest rate, and then if the interest rate goes down even lower than that in the future, they can refinance.”