Introducing Aridis Pharmaceuticals (NASDAQ:ARDS), The Stock That Slid 52% In The Last Year

The nature of investing is that you win some, and you lose some. Unfortunately, shareholders of Aridis Pharmaceuticals, Inc. (NASDAQ:ARDS) have suffered share price declines over the last year. The share price is down a hefty 52% in that time. Aridis Pharmaceuticals may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 39% in the last three months.

See our latest analysis for Aridis Pharmaceuticals

Aridis Pharmaceuticals isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Aridis Pharmaceuticals grew its revenue by 196% over the last year. That's a strong result which is better than most other loss making companies. Meanwhile, the share price slid 52%. Typically a growth stock like this will be volatile, with some shareholders concerned about the red ink on the bottom line (that is, the losses). We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

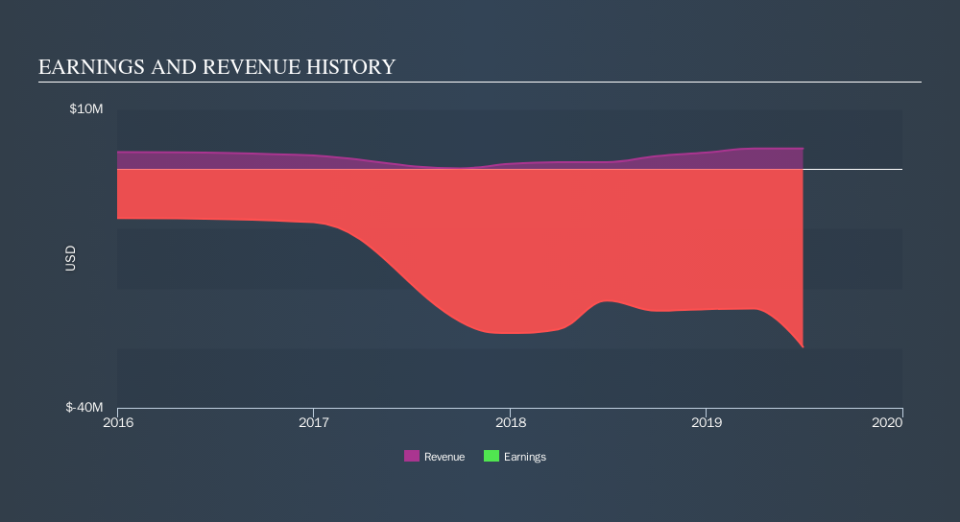

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Aridis Pharmaceuticals stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Given that the market gained 9.3% in the last year, Aridis Pharmaceuticals shareholders might be miffed that they lost 52%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 39% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.