Introducing Balfour Beatty (LON:BBY), The Stock That Dropped 16% In The Last Three Years

Balfour Beatty plc (LON:BBY) shareholders should be happy to see the share price up 10% in the last month. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 16% in the last three years, significantly under-performing the market.

Check out our latest analysis for Balfour Beatty

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Although the share price is down over three years, Balfour Beatty actually managed to grow EPS by 301% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

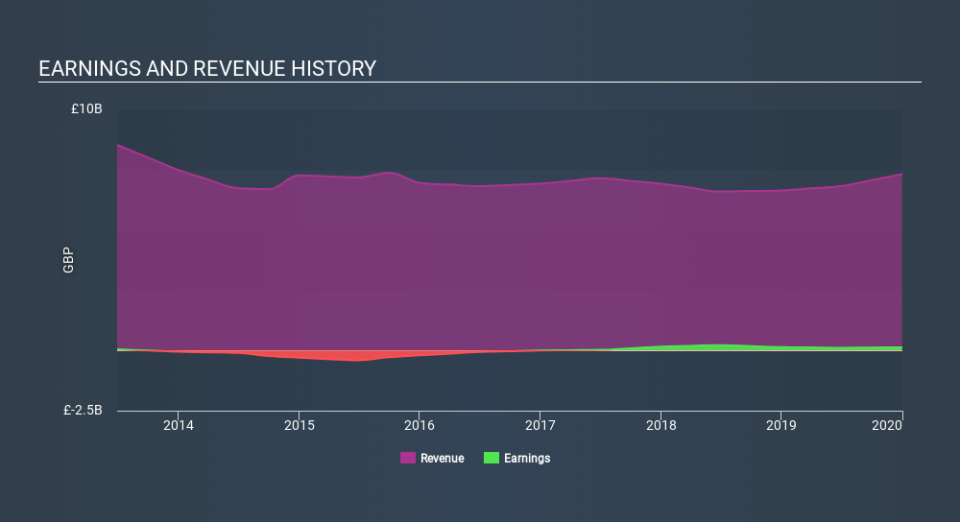

The company has kept revenue pretty healthy over the last three years, so we doubt that explains the falling share price. There doesn't seem to be any clear correlation between the fundamental business metrics and the share price. That could mean that the stock was previously overrated, or it could spell opportunity now.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Balfour Beatty has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Balfour Beatty the TSR over the last 3 years was -12%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While it's never nice to take a loss, Balfour Beatty shareholders can take comfort that , including dividends, their trailing twelve month loss of 4.7% wasn't as bad as the market loss of around 15%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 1.2% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. It's always interesting to track share price performance over the longer term. But to understand Balfour Beatty better, we need to consider many other factors. Even so, be aware that Balfour Beatty is showing 2 warning signs in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.