Introducing BuildingIQ (ASX:BIQ), The Stock That Tanked 95%

While it may not be enough for some shareholders, we think it is good to see the BuildingIQ, Inc. (ASX:BIQ) share price up 22% in a single quarter. But that doesn’t change the fact that the returns over the last three years have been stomach churning. Indeed, the share price is down a whopping 95% in the last three years. So it sure is nice to see a big of an improvement. The thing to think about is whether the business has really turned around.

We really feel for shareholders in this scenario. It’s a good reminder of the importance of diversification, and it’s worth keeping in mind there’s more to life than money, anyway.

View our latest analysis for BuildingIQ

BuildingIQ isn’t currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn’t make profits, we’d generally expect to see good revenue growth. That’s because it’s hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

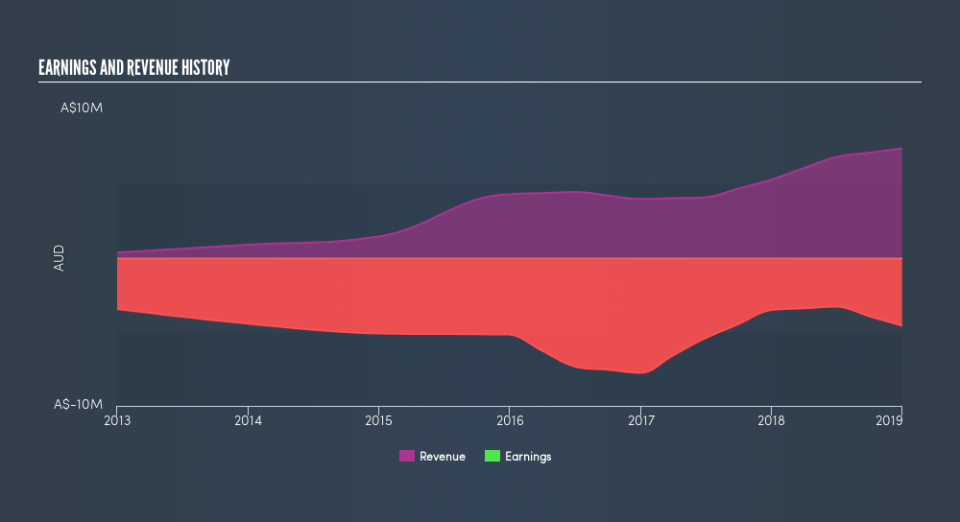

Over three years, BuildingIQ grew revenue at 22% per year. That is faster than most pre-profit companies. So why has the share priced crashed 63% per year, in the same time? You’d want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn’t amount to much if the business can’t scale well. Unless the balance sheet is strong, the company might have to raise capital.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

This free interactive report on BuildingIQ’s balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

BuildingIQ shareholders are down 44% for the year, but the broader market is up 8.0%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Unfortunately, the longer term story isn’t pretty, with investment losses running at 63% per year over three years. We’d need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. You could get a better understanding of BuildingIQ’s growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.