Introducing China Tian Yuan Healthcare Group (HKG:557), The Stock That Slid 60% In The Last Three Years

While it may not be enough for some shareholders, we think it is good to see the China Tian Yuan Healthcare Group Limited (HKG:557) share price up 10% in a single quarter. Meanwhile over the last three years the stock has dropped hard. Regrettably, the share price slid 60% in that period. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

Check out our latest analysis for China Tian Yuan Healthcare Group

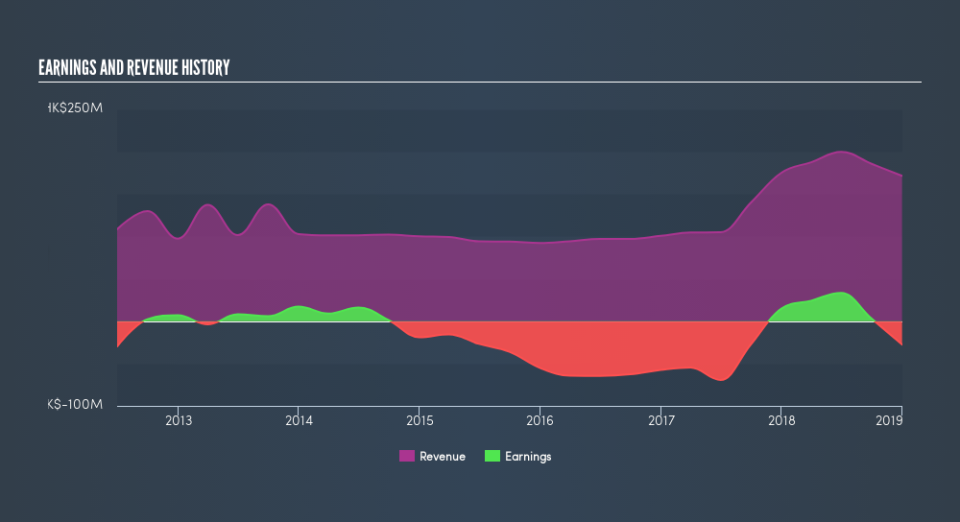

Because China Tian Yuan Healthcare Group is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, China Tian Yuan Healthcare Group grew revenue at 29% per year. That's well above most other pre-profit companies. The share price has moved in quite the opposite direction, down 26% over that time, a bad result. This could mean hype has come out of the stock because the losses are concerning investors. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We regret to report that China Tian Yuan Healthcare Group shareholders are down 22% for the year. Unfortunately, that's worse than the broader market decline of 1.6%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4.1% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of China Tian Yuan Healthcare Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.