Introducing China ZhongDi Dairy Holdings (HKG:1492), The Stock That Dropped 33% In The Last Three Years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term China ZhongDi Dairy Holdings Company Limited (HKG:1492) shareholders have had that experience, with the share price dropping 33% in three years, versus a market return of about 41%. And more recent buyers are having a tough time too, with a drop of 29% in the last year. There was little comfort for shareholders in the last week as the price declined a further 12%.

View our latest analysis for China ZhongDi Dairy Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

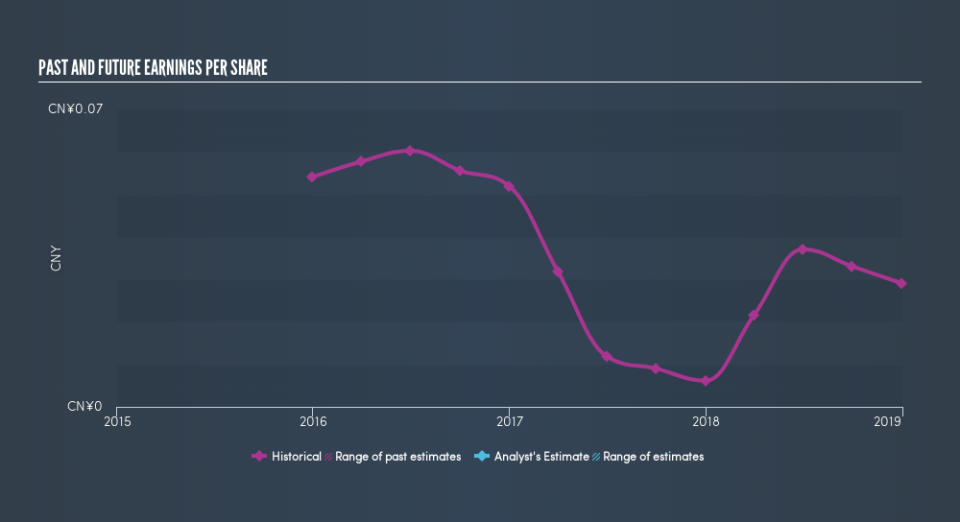

China ZhongDi Dairy Holdings saw its EPS decline at a compound rate of 19% per year, over the last three years. This fall in the EPS is worse than the 13% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into China ZhongDi Dairy Holdings's key metrics by checking this interactive graph of China ZhongDi Dairy Holdings's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for China ZhongDi Dairy Holdings shares, which performed worse than the market, costing holders 29%. The market shed around 1.6%, no doubt weighing on the stock price. The three-year loss of 13% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Before forming an opinion on China ZhongDi Dairy Holdings you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.