Introducing A.S. Création Tapeten (ETR:ACWN), The Stock That Slid 60% In The Last Three Years

If you love investing in stocks you're bound to buy some losers. But long term A.S. Création Tapeten AG (ETR:ACWN) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 60% in that time. And more recent buyers are having a tough time too, with a drop of 27% in the last year. There was little comfort for shareholders in the last week as the price declined a further 4.7%.

See our latest analysis for A.S. Création Tapeten

A.S. Création Tapeten isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, A.S. Création Tapeten's revenue dropped 5.9% per year. That is not a good result. With revenue in decline, and profit but a dream, we can understand why the share price has been declining at 27% per year. Having said that, if growth is coming in the future, now may be the low ebb for the company. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

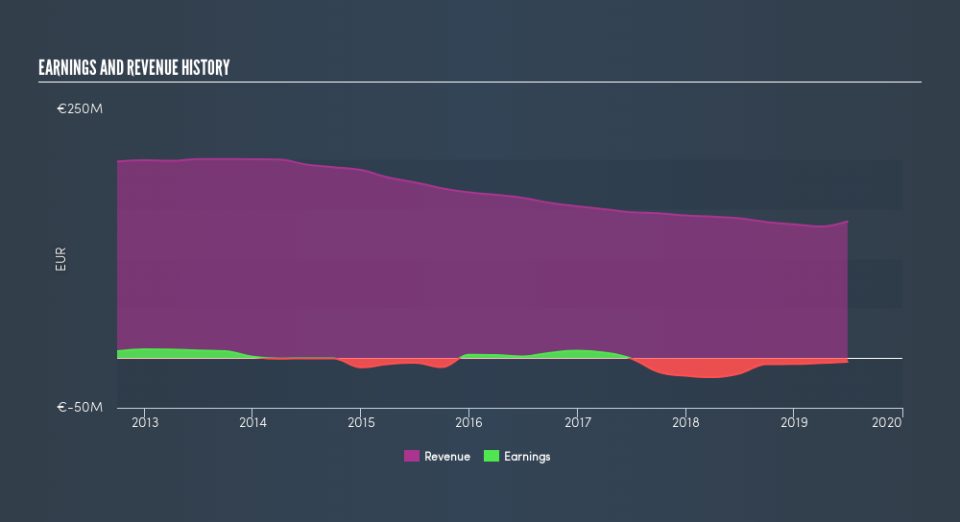

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on A.S. Création Tapeten's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between A.S. Création Tapeten's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for A.S. Création Tapeten shareholders, and that cash payout explains why its total shareholder loss of 59%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

While the broader market lost about 9.2% in the twelve months, A.S. Création Tapeten shareholders did even worse, losing 27%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You could get a better understanding of A.S. Création Tapeten's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: A.S. Création Tapeten may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.