Introducing Grid Dynamics Holdings (NASDAQ:GDYN), A Stock That Climbed 23% In The Last Year

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if when you choose to buy stocks, some of them will be below average performers. Over the last year the Grid Dynamics Holdings, Inc. (NASDAQ:GDYN) share price is up 23%, but that's less than the broader market return. Grid Dynamics Holdings hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Grid Dynamics Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Grid Dynamics Holdings saw its earnings per share (EPS) drop below zero. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. We might get a clue to explain the share price move by looking to other metrics.

Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

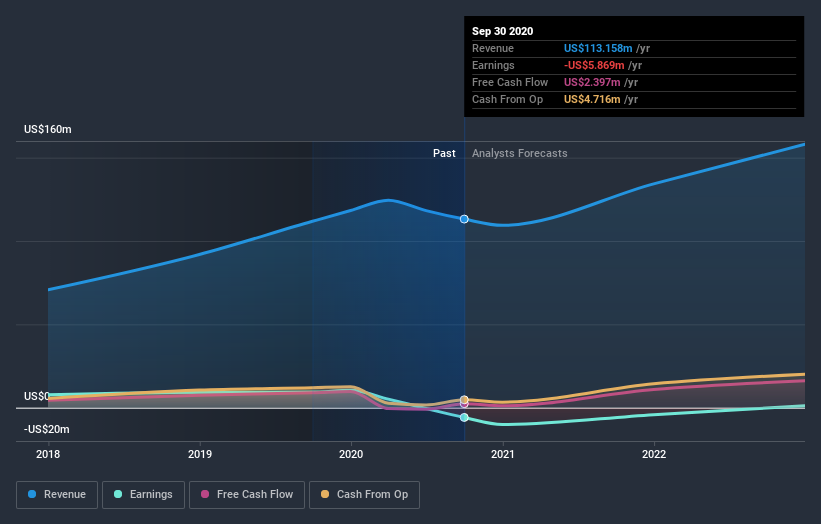

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Grid Dynamics Holdings stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Grid Dynamics Holdings shareholders have gained 23% for the year. Unfortunately this falls short of the market return of around 39%. Shareholders are doubtless excited that the stock price has been doing even better lately, with a gain of 33% in just ninety days. It's worth taking note when returns accelerate, as it can indicate positive change in the underlying business, and winners often keep winning. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Grid Dynamics Holdings .

Grid Dynamics Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.