Introducing Guidewire Software (NYSE:GWRE), A Stock That Climbed 78% In The Last Five Years

It hasn't been the best quarter for Guidewire Software, Inc. (NYSE:GWRE) shareholders, since the share price has fallen 16% in that time. But at least the stock is up over the last five years. In that time, it is up 78%, which isn't bad, but is below the market return of 124%.

Check out our latest analysis for Guidewire Software

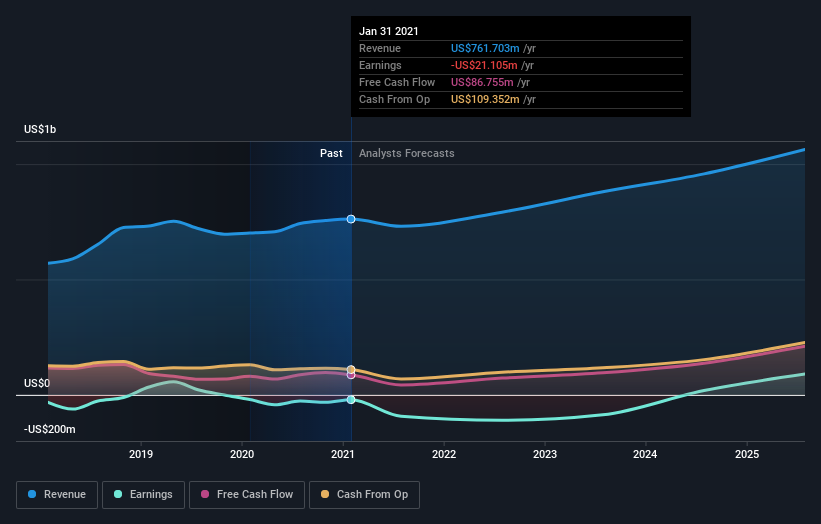

Because Guidewire Software made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Guidewire Software can boast revenue growth at a rate of 14% per year. That's a pretty good long term growth rate. The annual gain of 12% over five years is better than nothing, but falls short of the market. You could even argue that the share price was over optimistic, previously.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Guidewire Software in this interactive graph of future profit estimates.

A Different Perspective

Guidewire Software shareholders are up 9.7% for the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 12% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Guidewire Software that you should be aware of.

Guidewire Software is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.