Introducing Hong Kong Building And Loan Agency (HKG:145), The Stock That Tanked 83%

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We don't wish catastrophic capital loss on anyone. Anyone who held The Hong Kong Building And Loan Agency Limited (HKG:145) for five years would be nursing their metaphorical wounds since the share price dropped 83% in that time. Unfortunately the share price momentum is still quite negative, with prices down 8.6% in thirty days. However, we note the price may have been impacted by the broader market, which is down 3.8% in the same time period.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Hong Kong Building And Loan Agency

Given that Hong Kong Building And Loan Agency didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, Hong Kong Building And Loan Agency saw its revenue increase by 41% per year. That's better than most loss-making companies. So it's not at all clear to us why the share price sunk 30% throughout that time. It could be that the stock was over-hyped before. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

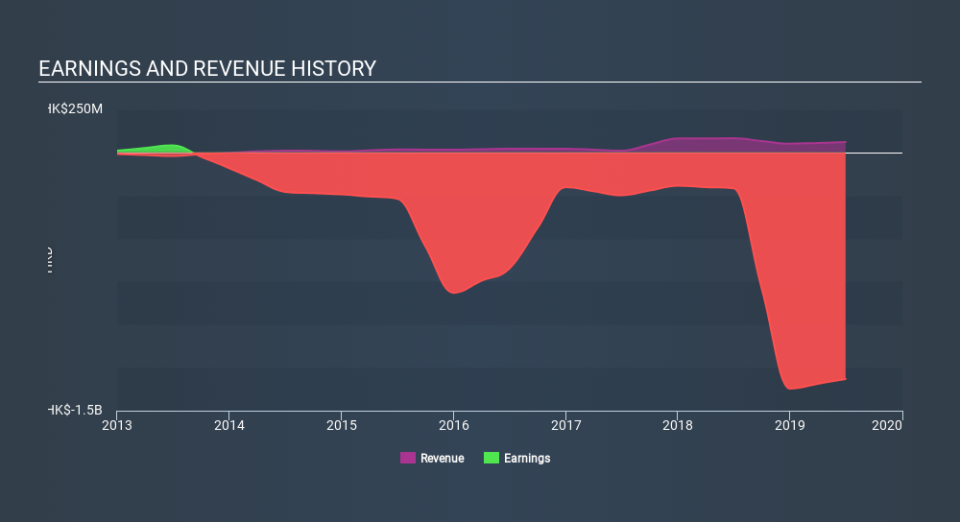

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Hong Kong Building And Loan Agency shareholders have received a total shareholder return of 23% over one year. There's no doubt those recent returns are much better than the TSR loss of 30% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.