Introducing ITE (Holdings) (HKG:8092), The Stock That Slid 64% In The Last Three Years

Over the last month the ITE (Holdings) Limited (HKG:8092) has been much stronger than before, rebounding by 52%. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 64% in that period. So it's good to see it climbing back up. Perhaps the company has turned over a new leaf.

View our latest analysis for ITE (Holdings)

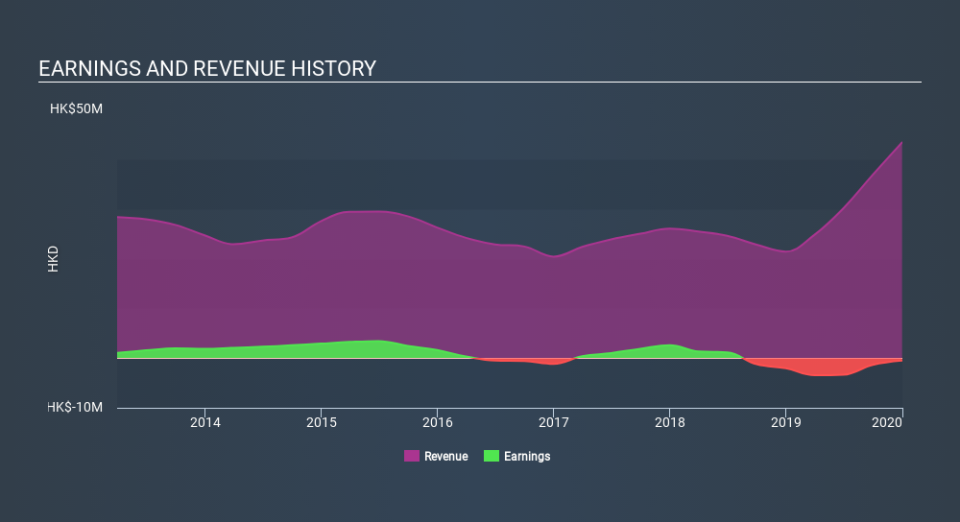

ITE (Holdings) isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, ITE (Holdings) saw its revenue grow by 18% per year, compound. That's a pretty good rate of top-line growth. So some shareholders would be frustrated with the compound loss of 29% per year. The market must have had really high expectations to be disappointed with this progress. So this is one stock that might be worth investigating further, or even adding to your watchlist.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that ITE (Holdings) shareholders have received a total shareholder return of 8.7% over the last year. There's no doubt those recent returns are much better than the TSR loss of 17% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for ITE (Holdings) (3 are a bit concerning) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.