Introducing Itesoft (EPA:ITE), The Stock That Dropped 42% In The Last Three Years

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term Itesoft S.A. (EPA:ITE) shareholders have had that experience, with the share price dropping 42% in three years, versus a market decline of about 3.0%. The falls have accelerated recently, with the share price down 11% in the last three months. But this could be related to the weak market, which is down 24% in the same period.

View our latest analysis for Itesoft

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Itesoft became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

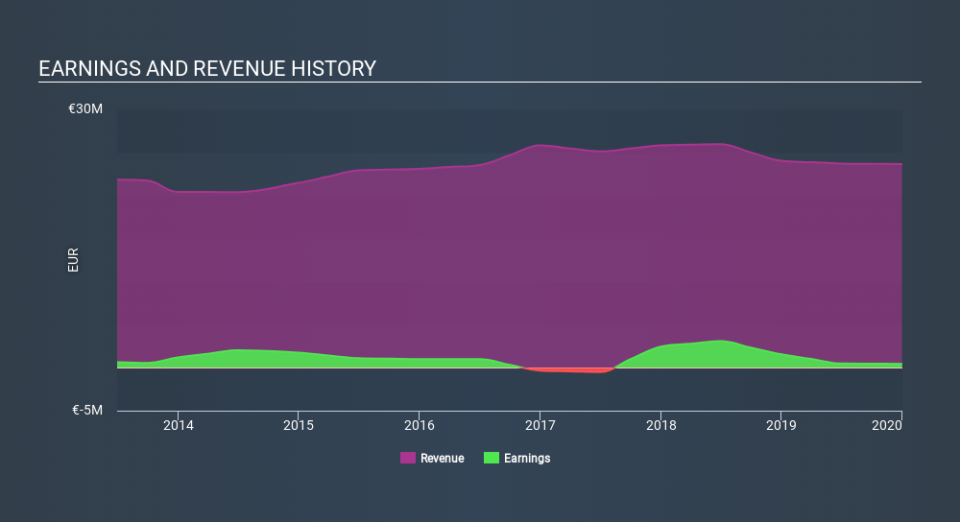

Arguably the revenue decline of 3.3% per year has people thinking Itesoft is shrinking. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Itesoft in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We've already covered Itesoft's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Itesoft's TSR of was a loss of 38% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Itesoft shareholders are down 17% for the year. Unfortunately, that's worse than the broader market decline of 12%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6.0% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Itesoft better, we need to consider many other factors. For instance, we've identified 3 warning signs for Itesoft that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.