Introducing Janison Education Group (ASX:JAN), A Stock That Climbed 42% In The Last Three Years

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Janison Education Group Limited (ASX:JAN), which is up 42%, over three years, soundly beating the market return of 12% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 33%.

See our latest analysis for Janison Education Group

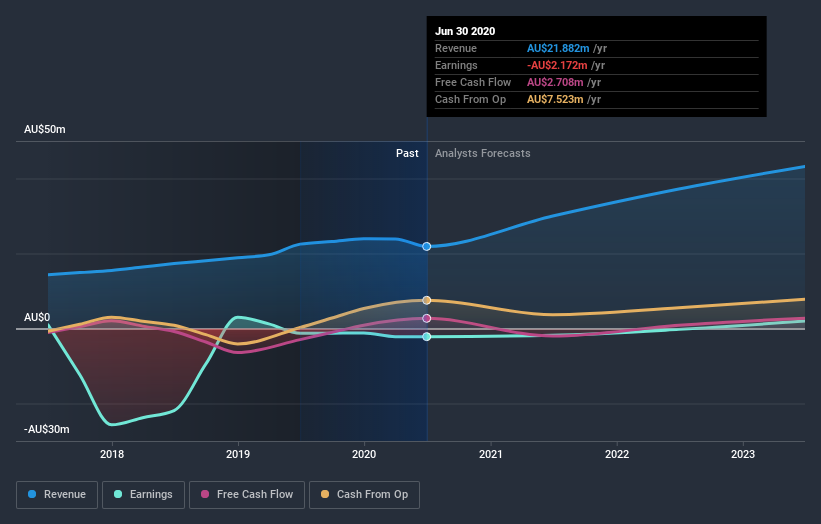

Given that Janison Education Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Janison Education Group saw its revenue grow at 18% per year. That's a very respectable growth rate. The share price gain of 12% per year shows that the market is paying attention to this growth. Of course, valuation is quite sensitive to the rate of growth. Keep in mind that the strength of the balance sheet impacts the options open to the company.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Janison Education Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Janison Education Group shareholders have gained 33% (in total) over the last year. That gain actually surpasses the 12% TSR it generated (per year) over three years. The improving returns to shareholders suggests the stock is becoming more popular with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Janison Education Group that you should be aware of before investing here.

But note: Janison Education Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.