Introducing JELD-WEN Holding (NYSE:JELD), The Stock That Dropped 26% In The Last Year

While not a mind-blowing move, it is good to see that the JELD-WEN Holding, Inc. (NYSE:JELD) share price has gained 13% in the last three months. But that doesn't change the reality of under-performance over the last twelve months. The cold reality is that the stock has dropped 26% in one year, under-performing the market.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for JELD-WEN Holding

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the JELD-WEN Holding share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past. It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

JELD-WEN Holding managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

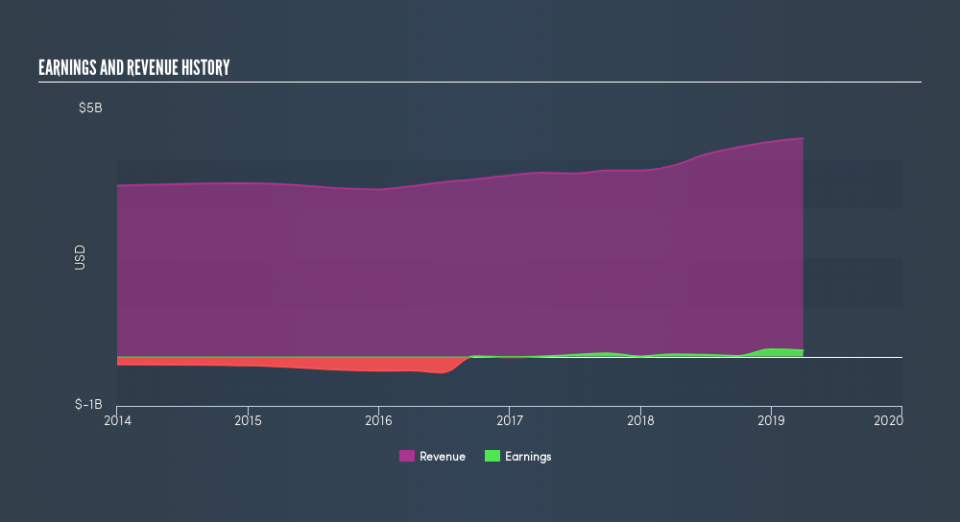

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

JELD-WEN Holding is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for JELD-WEN Holding in this interactive graph of future profit estimates.

A Different Perspective

While JELD-WEN Holding shareholders are down 26% for the year, the market itself is up 5.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 13% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). If you would like to research JELD-WEN Holding in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course JELD-WEN Holding may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.