Introducing Lepidico (ASX:LPD), A Stock That Climbed 91% In The Last Year

It might be of some concern to shareholders to see the Lepidico Limited (ASX:LPD) share price down 28% in the last month. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. Looking at the full year, the company has easily bested an index fund by gaining 91%.

Check out our latest analysis for Lepidico

Given that Lepidico didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Lepidico saw its revenue grow by 296%. That's a head and shoulders above most loss-making companies. The solid 91% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. If that's the case, now might be the time to take a close look at Lepidico. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

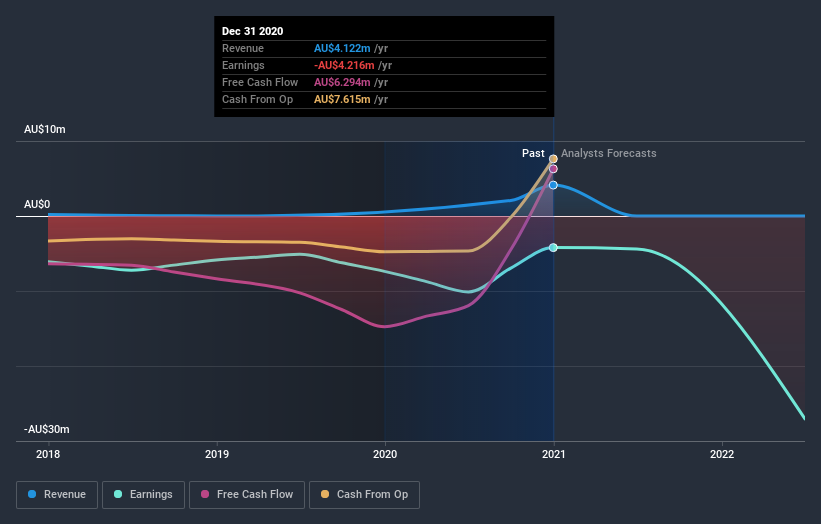

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Lepidico's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Lepidico hasn't been paying dividends, but its TSR of 93% exceeds its share price return of 91%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Lepidico shareholders have received a total shareholder return of 93% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 10% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 6 warning signs with Lepidico (at least 1 which is significant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.