Introducing Mayur Uniquoters (NSE:MAYURUNIQ), The Stock That Dropped 23% In The Last Year

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Mayur Uniquoters Limited (NSE:MAYURUNIQ) share price slid 23% over twelve months. That’s disappointing when you consider the market returned 4.7%. At least the damage isn’t so bad if you look at the last three years, since the stock is down 13% in that time. Unhappily, the share price slid 1.8% in the last week.

Check out our latest analysis for Mayur Uniquoters

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

Even though the Mayur Uniquoters share price is down over the year, its EPS actually improved. It’s quite possible that growth expectations may have been unreasonable in the past. It’s surprising to see the share price fall so much, despite the improved EPS. So it’s easy to justify a look at some other metrics.

Given the yield is quite low, at 0.9%, we doubt the dividend can shed much light on the share price. Mayur Uniquoters managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don’t readily explain the share price drop, there might be an opportunity if the market has overreacted.

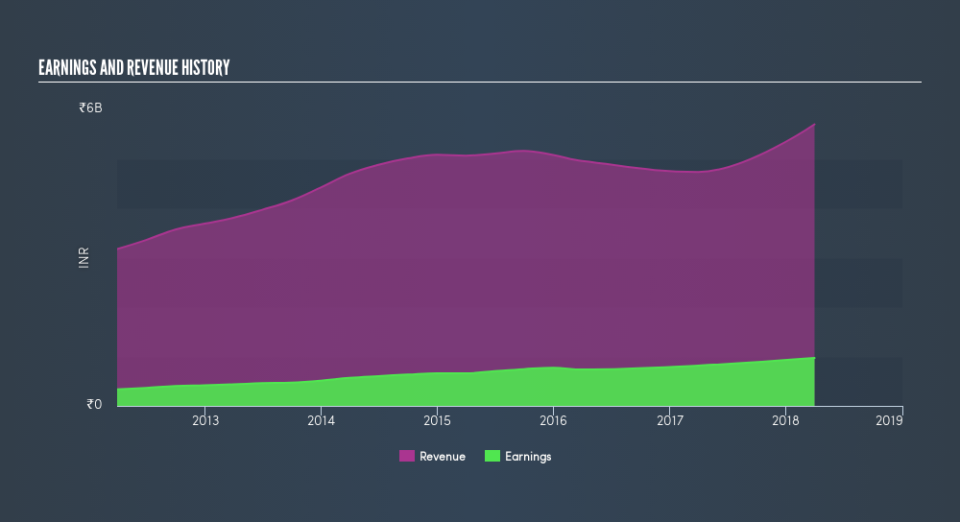

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We know that Mayur Uniquoters has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Mayur Uniquoters will earn in the future (free profit forecasts)

What about the Total Shareholder Return (TSR)?

We’d be remiss not to mention the difference between Mayur Uniquoters’s total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Mayur Uniquoters’s TSR of was a loss of 22% for the year. That wasn’t as bad as its share price return, because it has paid dividends.

A Different Perspective

Investors in Mayur Uniquoters had a tough year, with a total loss of 22% (including dividends), against a market gain of about 4.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 2.1% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before deciding if you like the current share price, check how Mayur Uniquoters scores on these 3 valuation metrics.

If you would prefer to check out another company — one with potentially superior financials — then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.