Introducing MYR Group (NASDAQ:MYRG), The Stock That Zoomed 272% In The Last Five Years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. Long term MYR Group Inc. (NASDAQ:MYRG) shareholders would be well aware of this, since the stock is up 272% in five years. Also pleasing for shareholders was the 24% gain in the last three months.

View our latest analysis for MYR Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

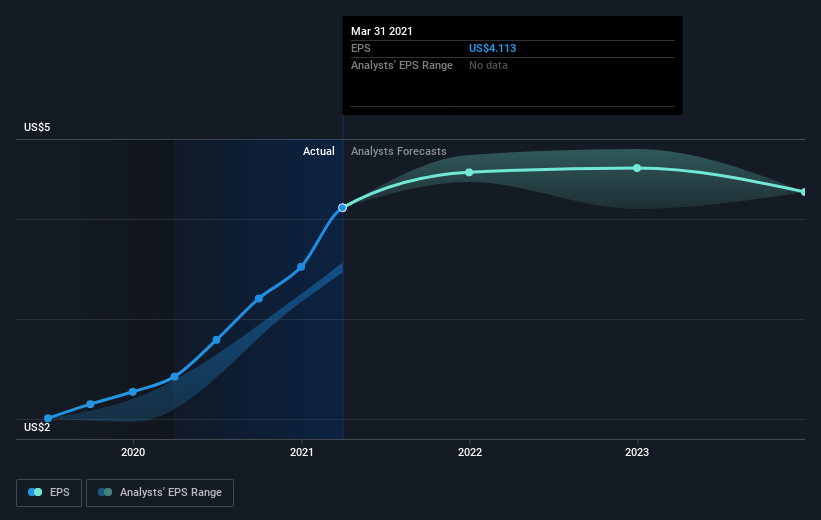

During five years of share price growth, MYR Group achieved compound earnings per share (EPS) growth of 30% per year. This EPS growth is remarkably close to the 30% average annual increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how MYR Group has grown profits over the years, but the future is more important for shareholders. This free interactive report on MYR Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that MYR Group shareholders have received a total shareholder return of 193% over the last year. That gain is better than the annual TSR over five years, which is 30%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with MYR Group .

Of course MYR Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.