Introducing Nanfang Communication Holdings (HKG:1617), A Stock That Climbed 13% In The Last Year

Passive investing in index funds can generate returns that roughly match the overall market. But you can significantly boost your returns by picking above-average stocks. For example, the Nanfang Communication Holdings Limited (HKG:1617) share price is up 13% in the last year, clearly besting than the market return of around -4.8% (not including dividends). That's a solid performance by our standards! We'll need to follow Nanfang Communication Holdings for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Nanfang Communication Holdings

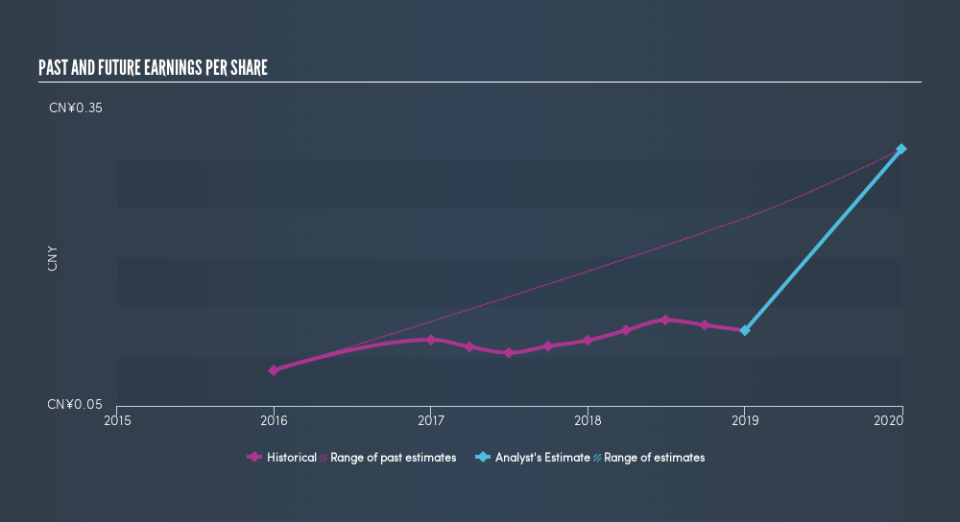

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Nanfang Communication Holdings was able to grow EPS by 8.5% in the last twelve months. The share price gain of 13% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Nanfang Communication Holdings's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Nanfang Communication Holdings, it has a TSR of 15% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Nanfang Communication Holdings shareholders have gained 15% over the last year, including dividends. Unfortunately the share price is down 5.6% over the last quarter. Shorter term share price moves often don't signify much about the business itself. Before deciding if you like the current share price, check how Nanfang Communication Holdings scores on these 3 valuation metrics.

But note: Nanfang Communication Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.