Introducing Noront Resources (CVE:NOT), The Stock That Slid 57% In The Last Five Years

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Generally speaking long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. To wit, the Noront Resources Ltd. (CVE:NOT) share price managed to fall 57% over five long years. That's not a lot of fun for true believers. We also note that the stock has performed poorly over the last year, with the share price down 34%.

Check out our latest analysis for Noront Resources

Noront Resources hasn't yet reported any revenue, so it's as much a business idea as an actual business. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, investors may be hoping that Noront Resources finds some valuable resources, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Noront Resources investors have already had a taste of the bitterness stocks like this can leave in the mouth.

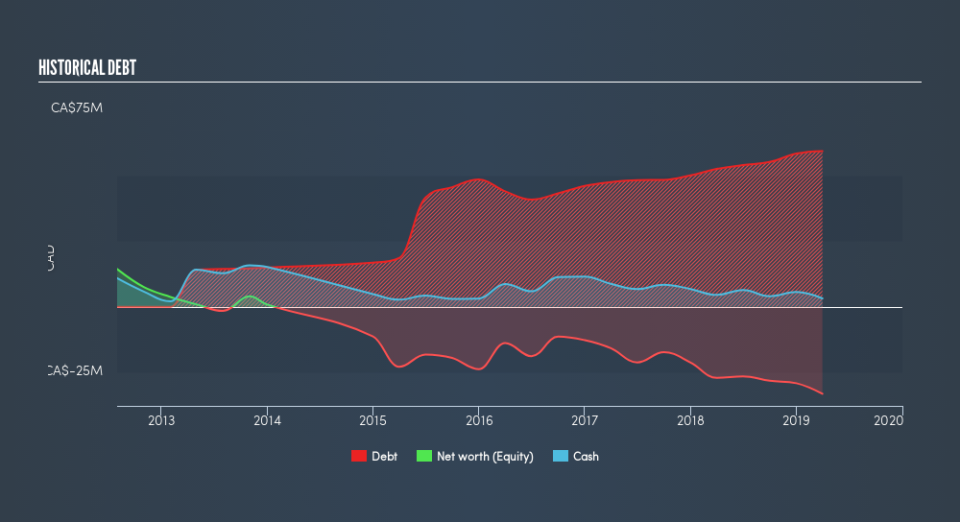

Noront Resources had liabilities exceeding cash by CA$61,088,011 when it last reported in March 2019, according to our data. That puts it in the highest risk category, according to our analysis. But with the share price diving 15% per year, over 5 years, it's probably fair to say that some shareholders no longer believe the company will succeed. The image below shows how Noront Resources's balance sheet has changed over time; if you want to see the precise values, simply click on the image. You can see in the image below, how Noront Resources's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. You can click here to see if there are insiders selling.

A Different Perspective

Investors in Noront Resources had a tough year, with a total loss of 34%, against a market gain of about 0.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 15% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Noront Resources may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.